Capital market raises R$35bn in October, reaching R$275bn in the year

Transactions in the capital markets raised R$35.3 billion in October, the second-largest amount in the year, a 43.7% increase from September. The total raised through October from a year ago dropped 18.5% to R$275.1 billion. Ongoing offerings and those under review are expected to reach R$17.6 billion and R$10.8 billion (excluding share offerings), respectively.

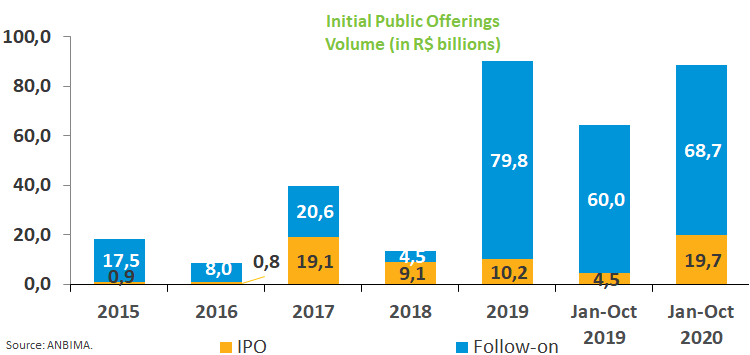

Share offerings raised R$19.1 billion, accounting for 54.2% of the total in the month. Secondary offerings (follow-ons) represented 37.6%, almost three times the September volume, an 88.9% increase compared with the same period in 2019. The IPOs accounted for 16.6% of the total in in October, the highest in the year in absolute terms (R$5.8 billion) from 14.2% in the previous month, showing the good momentum in the stock market as a source of funds for companies, totaling 16 firms going public in the period, in addition to five with offerings priced but not yet completed by October.

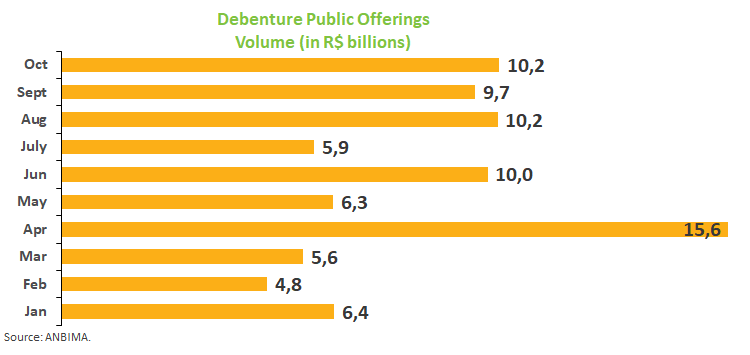

Debenture issuances also stood out and raised R$10.2 billion last month, accounting for 29% of the total and up 5.8% from September. Intermediaries and participants linked to offerings hold the lion’s share in the year, with 73.1% of the total, though a smaller slice than in the first half. Investment funds accounted for 15.4% compared with 54.6% a year ago. The average placement term in the year through October was 6.3 years, below the 5.8 years in the same period last year. Most of the proceeds were allocated to working capital (35.9%) and refinancing liabilities (23.4%).

Securitization securities - including CRI, CRA and FIDC - raised R$2.4 billion, down 56.2% from September. In the year to date, such assets accounted for 18% of the total issued compared with 16.7% in the same period a year ago. Real estate investment funds, which own part of these assets, raised R$3.1 billion, 29.6% more than in September. In the year through October, the amount issued in the segment totaled R$32.9 billion against R$28 billion in the same period in 2019.

Share offerings were back in the external markets for the first time since February, with two transactions that raised US$ 0.3 billion. There were also two bond offerings totaling US$1.5 billion. The total amount of issuances abroad (bonds and equities) reaches US$23.5 billion in the year through October.