Capital markets fundraising increases 54% through May

Fundraising reached R$ 198 billion in the first five months of the year, up 54.1% from the same period in 2020. The amount raised in May alone totaled R$ 55 billion, 31.9% more than in April. Ongoing and under-review offerings total R$ 13.1 billion and R$ 7.8 billion, respectively.

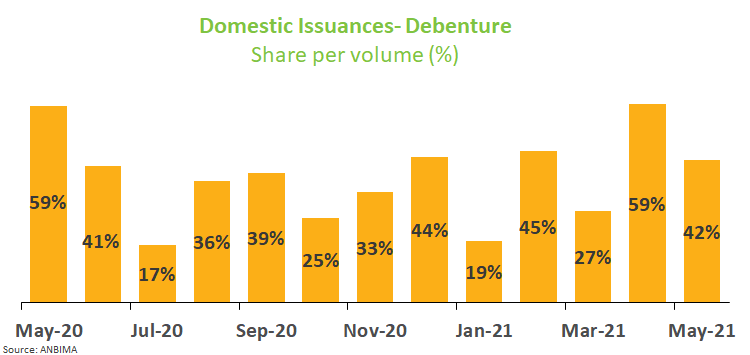

Among securities issued, debentures led fundraising and accounted for 42.5% of the total, or R$ 23.3 billion. From January through May, the amount raised by debentures was about twice as high as in the same period last year.

The proceeds raised by debentures in 2021 were mainly allocated to working capital (31.3%) and infrastructure investment (18.8%), accounting for virtually half of the amount. As for the subscribers’ profile, there was no significant change – most of them remain intermediaries and other participants linked to offerings (46.5%) and mutual funds (33.7%).

Still in fixed income, the FIDCs outperformed by raising R$ 8.65 billion in May – the year’s second-best mark, only behind March. The result is significantly higher than in April, when R$ 3.3 billion were raised. In the year to date, the FIDCs raised R$ 27.4 billion compared with R$ 16.2 billion in the same period last year. Commercial papers, on the other hand, sold R$ 2.8 billion in May alone, accounting for 52% of the total raised in the segment since January.

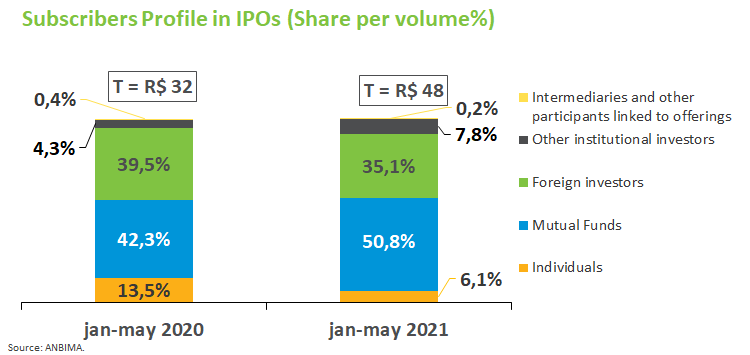

Share offerings reached R$ 10.3 billion in May. While April did not see any IPO, about half of funds raised in May came from initial public offerings. As the economy recovers and vaccination picks up, IPOs could keep the growing trend in the next months. There are still about R$ 8.4 billion in ongoing offerings. Share offerings already raised R$ 48 billion through May from R$ 31.6 billion a year earlier.

Among subscribers to share offerings, more than half are mutual funds (50.8%), followed by foreign investors (35.1%). In the first five months, the relative share of individuals in the offerings fell by more than half, to 6.1% from 13.5% in 2020.

Real estate funds were also outperformers, raising R$ 4.2 billion, 55.3% more than in April and bringing the year-to-date amount to R$ 21 billion from R$ 15.4 billion in the same period of 2020.

In international markets, there were two bond issues totaling $ 1.4 billion, which places the amount raised through May at $ 8.95 billion, already surpassing the $ 8 billion seen in the first five months of 2021.