Capital markets issuances surpass R$ 300 billion in 2020

Capital markets issuances raised R$ 25.8 billion in November, down 34.9% from October. The top funding instruments, debentures and shares, raised smaller amounts, reflecting to some extent uncertainties on the economy front. The number of transactions was also lower, falling from 164 in October to 90 in November. In the year, the amount raised totaled R$ 305 billion, 19.8% below from the same period last year. Registered offerings in progress and under analysis show expected volumes of R$ 11.4 billion and R$ 6.4 billion, respectively.

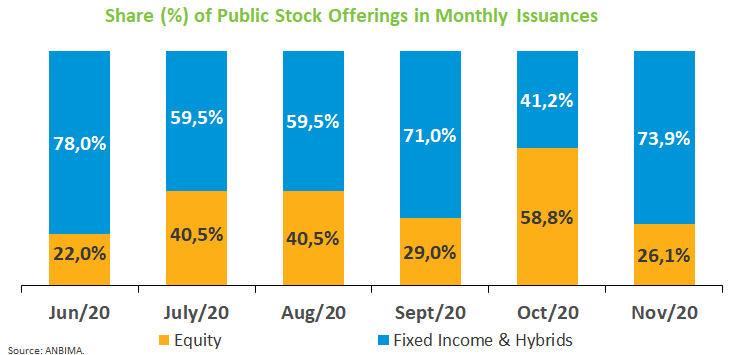

Stock offerings raised R$ 6.7 billion in November, accounting for 26.1% of the total raised in the month, the lowest share since June. Secondary offerings (follow-ons) totaled R$ 598 million against R$ 13.3 billion in the previous month, while initial public offerings raised R$ 6.1 billion from R$ 10 billion in the same comparison period.

Debentures raised R$ 8.7 billion in November, down 15.4% from October and accounted for 33.6% of the total issued in the month. Such securities raised R$ 93.5 billion through November compared with R$ 166.8 billion in the same period last year. Intermediaries and participants linked to offerings held the lion’s share of debentures issued in the year, with 69.6% of the total, while mutual funds accounted for 17.6% in the same period. Most proceeds keep being allocated to working capital (36.7%) and debt refinancing (31.2%), which in the latter included buybacks or redemption of debentures previously issued.

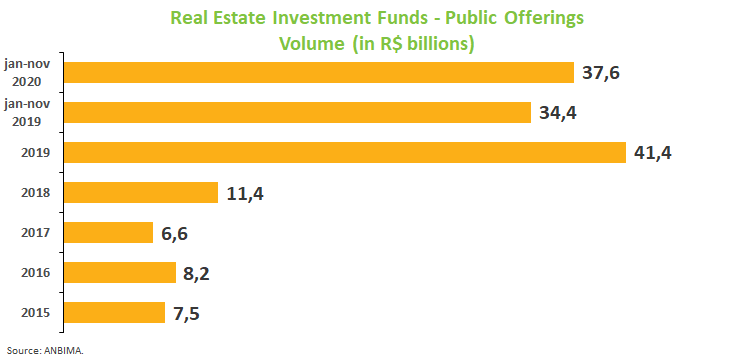

Real estate investment funds were among the few instruments that raised more in November than in the previous month, totaling R$ 4.7 billion, up 50.7% from October. In the year, the amount raised totals R$ 37.6 billion compared with R$ 34.4 billion in the same period of 2019, a 9.2% increase.

Overseas, four debt issuances raised $ 1.4 billion, with no share offering in November. The total raised through November reached $ 24.8 billion, with debt sales accounting for 90%.