Capital markets raise 23% more in February to R$ 26.2bn

The capital markets raised R$ 26.2 billion in February, up 23% from the previous month. In the year, the total issued amounts to R$ 47.5 billion from R$ 63.7 billion a year ago, down 25.4%, though in February 2020 the result reflected Petrobras’s R$ 22 billion share offering. Ongoing and under analysis offerings (excluding stock offerings) total R$ 24.6 billion and R $ 9.9 billion, respectively.

Debenture sales accounted for 48.3% of February's volume, totaling R$ 12.7 billion, more than triple from January (R$ 4 billion). Intermediaries and other participants linked to the offering represented 65.9% of placements, followed by investment funds, with 19%.

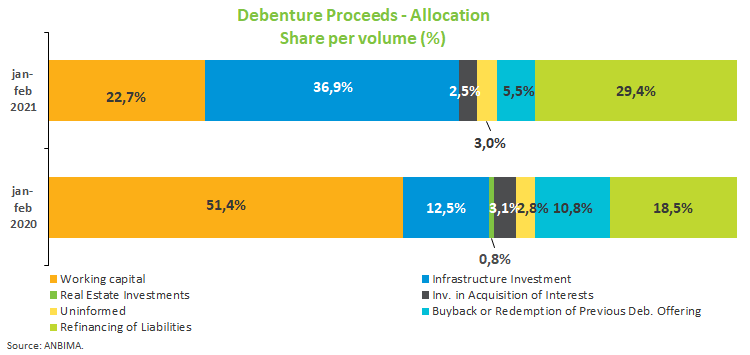

However, unlike in previous months, most proceeds from debentures issued were allocated to investments in infrastructure: 36.9% up to February. In the same period last year, this allocation accounted for only 12.5% of the volume offered. This result is largely due to the 11 issuances of infrastructure bonds under Law 12,431.

Share offerings represented 33.4% of the total raised at R$ 8.8 billion. Of this amount, R$ 6.3 billion were follow-on transactions (secondary share offerings) while initial public offerings accounted for R$ 2.5 billion. Among offerings in progress under CVM Instruction 400 (priced sales but which have not yet been settled), R$ 16.7 billion in IPOs are expected to be settled in the coming months.

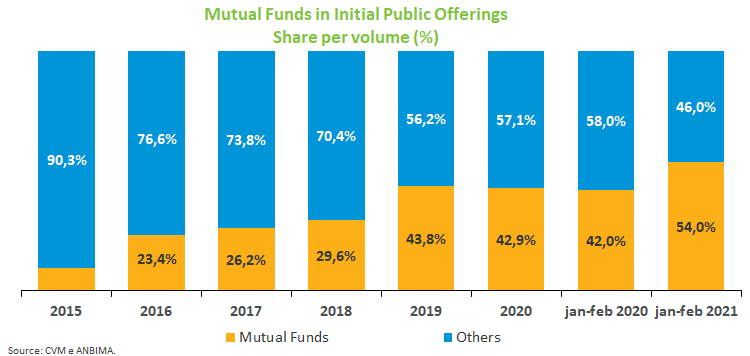

The largest equity subscribers were mutual funds, with 54% of the amount placed, followed by foreigners and other institutional investors, with 30% and 13.6%, respectively. Nearly 58.7% of the amount raised was allocated to acquisition of assets and operating activities, followed by purchase of equity stakes, with 27.6%.

Real estate investment funds raised R$ 1.3 billion, 80.2% below the amount issued in January. In the year, they raised R$ 7.6 billion, up 6.6% from the same period in 2020.

In the overseas market, funding totaled $ 1.4 billion in February from $ 5.2 billion in January, all through debt sales. The year-to-date amount totals $ 6.6 billion from $ 9.5 billion in the first two months of 2020.