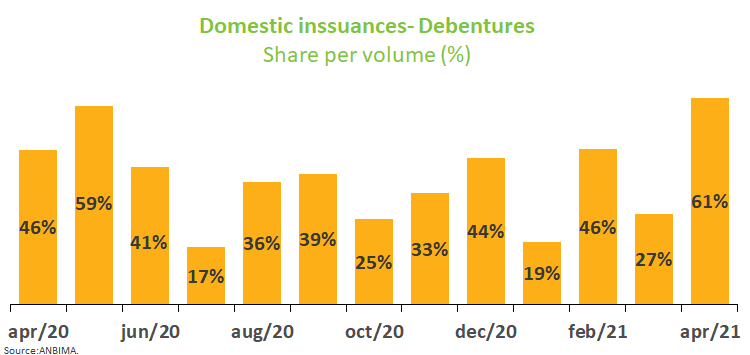

Debentures account for 61.3% of April issuances

Capital markets raised R$ 39.6 billion in April, down 25.7% from March. In the year through April, issuances totaled R$ 141.9 billion from R$ 117.9 billion in the same period of 2020, a 20.4% increase. Offerings in progress and under analysis total R$ 16.5 billion and R$ 7.6 billion, respectively.

Debentures stood out, accounting for 61.3% of issuances in April, or R$ 24.3 billion, up 70.2% from the previous month. Vale’s R$ 11.5 billion debenture offering in April accounted for almost 50% of the total placement in such securities in the period. In 2021, debenture sales already total R$ 55.3 billion from R$ 32.4 in the same period in 2020.

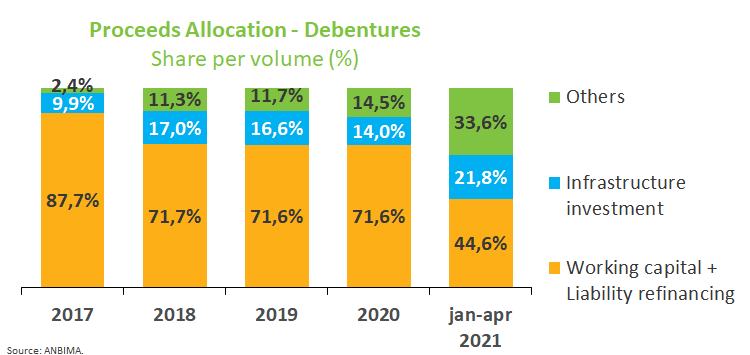

Most of the proceeds raised through debenture sales in the year to April went to intermediaries and other participants linked to offerings, accounting for a 46.9% share of placements, followed by investment funds, with 30.2%. Of the total raised, 44.6% went to working capital and refinancing liabilities (including buybacks or redemption of debentures previously issued) and 21.8% of the proceeds were allocated to infrastructure investments.

In the equity market, there were no initial public offerings in April, while in March R$ 18.8 billion were raised through IPOs. Higher volatility – amid a Covid surge and doubts on the fiscal side - may have added uncertainty for primary share offerings. Still, IPOs have already raised R$ 21.8 billion through April compared with R$ 3 billion in the same period in 2020. An opposite trend, follow-ons (secondary share offerings) in April totaled nearly R$ 5.4 billion after no transactions in March. In the year through April, equity offerings raised R$ 38.8 billion, up 24.2% compared with the same period in 2020.

Real estate investment funds raised R$ 2.1 billion, 65.3% down from March. In primary offerings under Instruction 400, individuals, who are tax-exempted, represented 77.8% of the total placed in the year through April. In offerings under Instruction 476, allowed only for professional investors, the individuals’ share was 15.8%. Through April, real estate funds issued R$ 16.2 billion, 14% above from a year ago.