Debentures raise R$120bn in the year, matching the 2020 figure

Fundraising in capital markets reached R$47 billion in July, bringing the year-to-date figure to R$304 billion, 62% more than in the same period in 2020.

Debentures repeated the good performance from the last three months and raised R$20.8 billion in July. The almost R$ 120 billion sold in the year through July already matches the amount raised in the entire 2020.

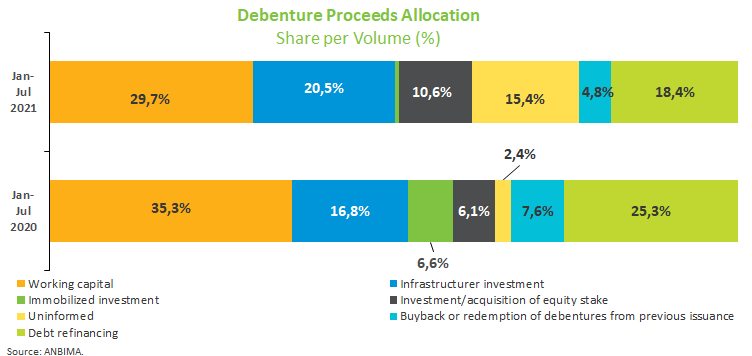

Working capital transactions continue to be the primary allocation of proceeds (29.7%), followed by infrastructure investment (20.5%) and debt refinancing (18.4%). There were no significant changes in the subscriber profile from the previous month: intermediaries and other participants linked to offerings accounted for 43.4% of the total in 2021, followed by mutual funds, with 35.4%.

As for fixed-income assets of smaller volume, commercial papers raised the year’s largest amount with R$3 billion. In turn, FIDCs had their worst performance in 2021, raising R$1 billion, less than a third of the amount sold in June.

Equity represented 37% of the total raised in July at R$17.6 billion. Follow-ons, or secondary share offerings, accounted for nearly the entire amount raised through equity transactions (R$ 16.2 billion). In the year, stocks already added R$90 billion to the total raised on the market, or 30% of the amount.

There are more than R$13 billion in initial public offerings in the pipeline, signaling positive prospects for the segment in the coming months. Taking that into account, IPOs would have raised R$54 billion since January.

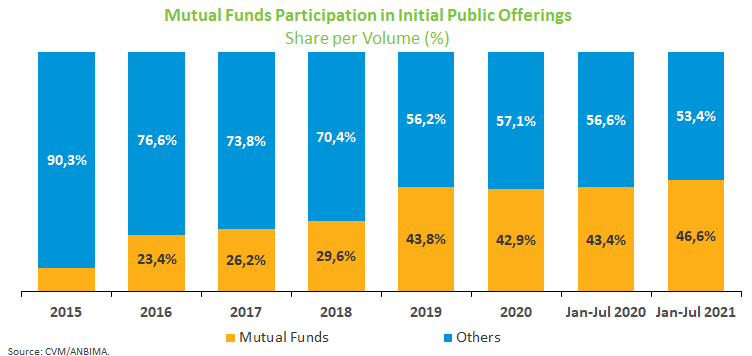

As for the subscribers profile, mutual funds (46.6%) and foreign investors (36.7%) remain the largest holders of equity assets in Brazil this year.

Issuances on the international markets raised $3.65 billion – $2.25 billion of which in Brazil’s sovereign debt.