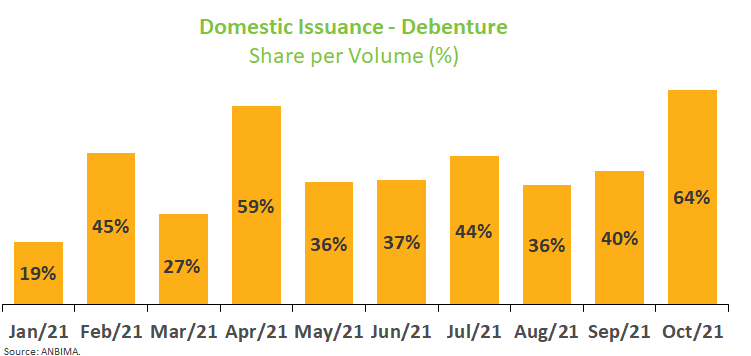

Debentures grab 64% of October issuances

Domestic issuances reached R$36.2 billion in October, taking the total raised in Brazil in the year to R$449.3 billion, up 21% from the same period in 2020. Despite the impressive annual figure, it is the first time since February that monthly funding falls below R$40 billion. The recent increases in the policy rate amid uncertainties on the economic front have reduced investor appetite, especially for equities.

Debentures saw their second-best performance int the year, only behind April, raising R$23.1 billion. The amount accounts for 63.8% of total funds raised in the capital markets in October, with debentures luring R$182 billion in 2021. The results were boosted by eight issuances above R$1 billion, which together totaled R$10.7 billion.

So far, most proceeds were allocated to working capital (29.2%), liability refinancing (21.1%) and infrastructure investment (20.3%). Intermediaries and other participants linked to issuances accounted for 42.5% of debenture subscribers, followed by mutual funds, with 39.3% of the offerings. The level is almost double the investment funds’ relative share compared to last year (23.5%), showing the growing interest of these agents in private fixed-income credit.

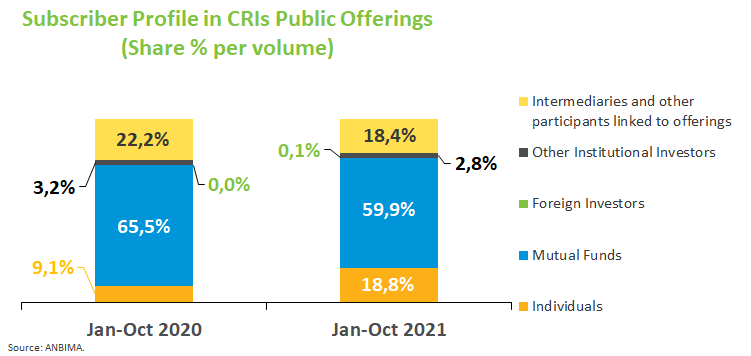

CRIs (Real Estate Receivables Certificates) raised R$3.4 billion in October, totaling more than R$24.6 billion in 2021, more than double from the same period last year. The majority of subscribers to these issuances are mutual funds (59.9%), followed by individuals (18.8%) and by intermediaries and other participants linked to offerings (18.4%).

Still in securitization bonds, FIDCs (Credit Rights Investment Funds) had a more discreet performance compared to the last two months, raising R$2.3 billion. The performance of CRAs (Agribusiness Receivables Certificates) were slightly above the average for the year with just over R$1.6 million attracted in October. Ongoing issuances and securitization bonds under review total R$13.3 billion.

Stock offerings had a lukewarm performance in October. There was only one follow-on, or secondary share offering, of R$1.1 billion. Even with no ongoing offering, equities raised more than R$125 billion since January.

There was no issuance overseas in October.