Fundraising drops 12% in the first half to R$233bn

Brazilian capital markets raised R$49.4 billion in June, up 8.6% from May. In the first half, the volume fell 12.1%, to R$233 billion from the same period in 2021. Offerings in progress and those under review totaled R$47.4 billion and R$13.6 billion, respectively (excluding share offerings).

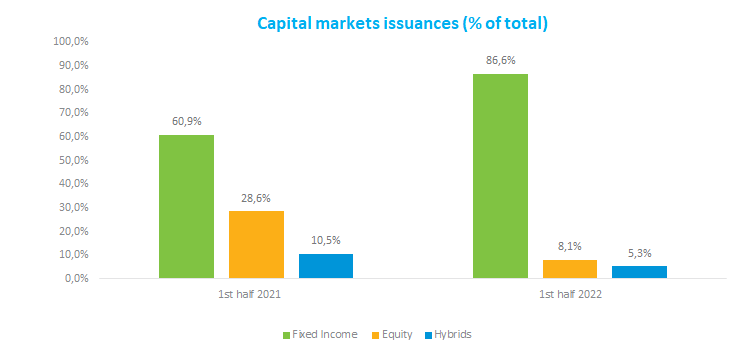

Fixed-income transactions accounted for 86.6% of total issuances, mirroring Brazil’s monetary tightening cycle started in March 2021 that may continue amid revisions pointing to higher inflation expectations. In the first half of 2021, when interest rates ranged from 2% to 4.25%, fixed income represented 61% of issuances while equity accounted for 29% of the total.

Debentures are still the most representative instrument, with a 56% slice of total issuances in the capital markets in June, or R$27.6 billion. In the first six months, debentures represented 57% of the total, equivalent to R$133.8 billion, well above their share in the first half of 2021, when they accounted for 37% of total issuances, or R$98.9 billion.

Among investors subscribed to offerings, almost half (48.9%) corresponded to intermediaries and other participants linked to transactions. Mutual funds came next, with 39.8% of the total placed, increasing their share compared to the first half of 2021 (34.8%). In terms of allocation, working capital and liability refinancing accounted for 60% of the volume, with 36.7% and 23.6%, respectively. Infrastructure investments corresponded to 18.1% of the total placed.

Regarding structured fixed-income products (CRI, CRA and FIDC), R$49.7 billion were issued in the first six months compared with R$56.8 billion a year earlier, a 12.4% decline. However, such vehicles kept their share both in the first half of 2022 and in the same period last year, with 21% of total issuances.

In the equity market, initial public offerings totaled R$406 million from January through June, related to a single IPO, while follow-on issuances, or secondary share offerings, amounted to R$5.6 billion in June and R$18.5 billion in the year.

No issuances were launched in the international markets in June. In the first half, there were 11 transactions: $5 billion in bond sales and $43 million in stock offerings.