Fundraising exceeds R$400 bn in 2021

Capital markets raised R$45.3 billion in September, now totaling R$404.8 billion issued in 2021. With three months to the end of 2021, domestic issuances are 8, 8% up from the total raised in 2020. Ongoing and under review offerings amount to R$21 billion.

Debentures raised R$17.9 billion in September and accounted for 64.4% of bond issuances in the month. With just over R$155 billion raised in 2021 - more than double from the same period last year -, debenture sales are already 27% higher than in the entire 2020 and on track to beat the R$184.5 billion issued in 2019, which would be the highest level raised since 2015. Debenture proceeds have been most allocated to working capital (26.5%) and infrastructure investment (20.7%) in the year, with the largest holders being intermediaries and other participants linked to offerings (45.1%), followed by investment funds (36.7%).

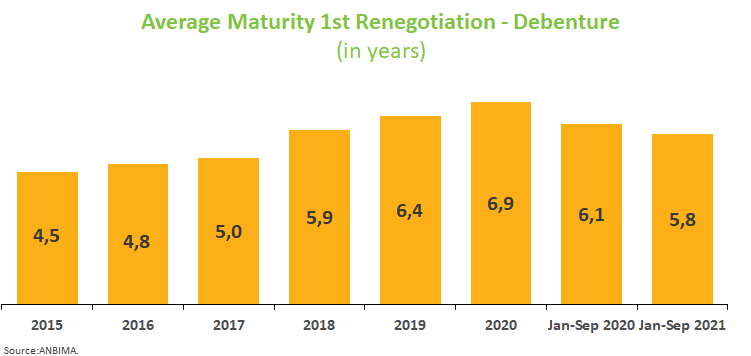

Debentures’ maturity profile showed significant changes. In the year to September, 41.7% of issuances were due between four and six years – in 2020 that share was 31%. Three-year debentures, which previously accounted for 33.9%, now represent 26%. And bonds maturing in 10 years or more, accounting for 16.8% in 2020, currently represent 21% of total issuances. Longer-term bonds become more relevant precisely due to a period of higher market volatility.

Credit Receivables Investment Funds outperformed in September, raising R$3.5 billion – the second-largest value in the segment for the year. Certificates of Agribusiness Receivables also performed well, with R$2.1 billion in the month, nearly doubling the amount seen in August.

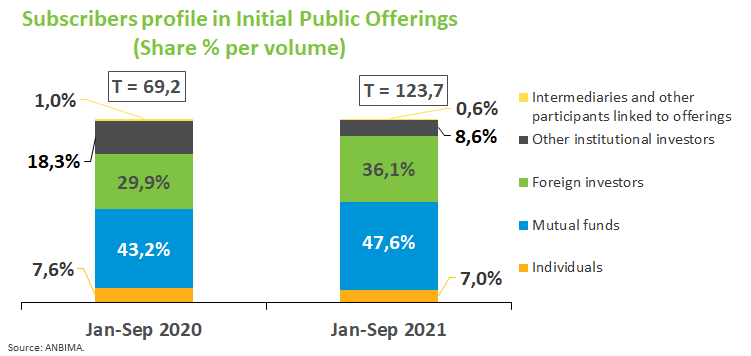

In Equities, issuances totaled R$15 billion, of which R$12.1 billion came from initial public offerings and R$2.9 billion from follow-ons (secondary share offerings). Now the volume raised through Equities total R$123.7 billion in 2021, already delivering the best year for the asset class since 2015. Mutual funds (47.4%) and foreign investors (36%) are still the largest subscribers to share offerings. The overseas market had five bond issuances, which raised $2.75 billion in the period.

The overseas market had five bond issuances, which raised $2.75 billion in the period.