Fundraising surpasses R$200 billion-mark in local capital market

The local capital market raised R$206.8 billion in the year to July, a 35% increase compared with the R$153 billion in the same period last year. The number of transactions decreased 10.1%, to 473 in the first seven months from 526 through July 2018. Debentures have been the instrument with the largest share in the issued volume: 46.4% of the total, or R$95.9 billion.

However, share offerings have taken a leading role in the segment since June, accounting for the largest amount of the total issued in the month. July saw R$20.8 billion raised in five follow-ons, which accounted for 73% of the total raised. There were no initial public offerings, or IPOs. As for the number of transactions, there were 17 offerings year to date compared with 4 until July 2018. The share of institutional investors in public offerings rose to 46.6% compared with 27.9% in the same period last year.

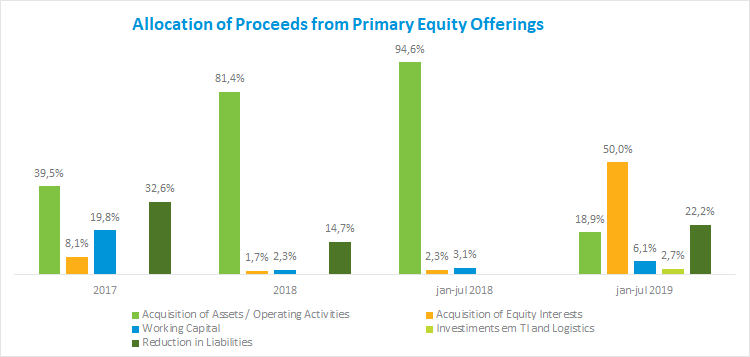

One aspect that stands out in the higher volume of stock offerings is the profile of fund allocation, which differs from the one seen in the last two years. Compared with the same period of 2018, the acquisition of equity stakes accounts for most transactions (50% against 2.3% a year ago). However, the acquisition of assets and other operating activities decreased significantly (to 18.9% of the total in July 2019 from 94.6% in the previous year). Funding to cut liabilities accounted for 22% of the total, with no issuance seen until July last year.

Debenture offerings raised R$1.5 billion in July, which corresponds to 5.3% of the total issued in the month. Institutional investors account for the largest share in public offerings, especially in the so-called 476 transactions, in which they hold 65.8% of the total placed. Regarding the infrastructure bond offerings, issued through Law 12,431, institutional investors represent 50.2% of the volume, while individuals, who are exempt from Income Tax, account for 26.3% of the total placed in the segment.

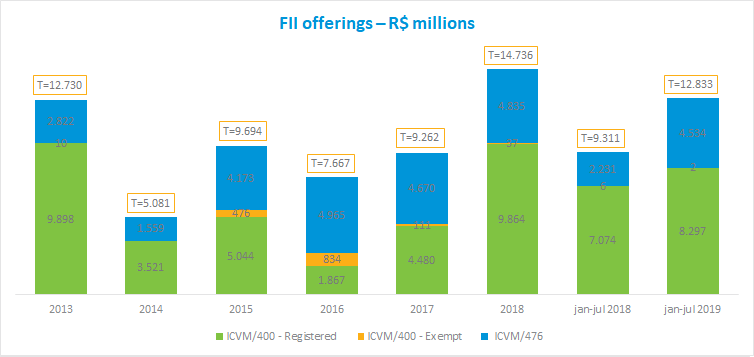

The evolution of real estate investment funds indicates their potential growth, especially if there is a more consistent recovery of the real estate segment in the country. The R$12.8 billion issued through July is 37.8% above the amount a year ago (R$9.3 billion), and already accounts for 87% of the total raised in 2018. Offerings through this instrument represent only 6.2% of the total placed this year, practically the same portion of 2018 (6%).

Six offerings were launched overseas in July, totaling $2.8 billion. In the year to date through July, the total raised was $15.7 billion, slightly surpassing the amount in the same period of 2018 ($15.3 billion), with fixed income accounting for $14.5 billion and equity for $1.2 billion.