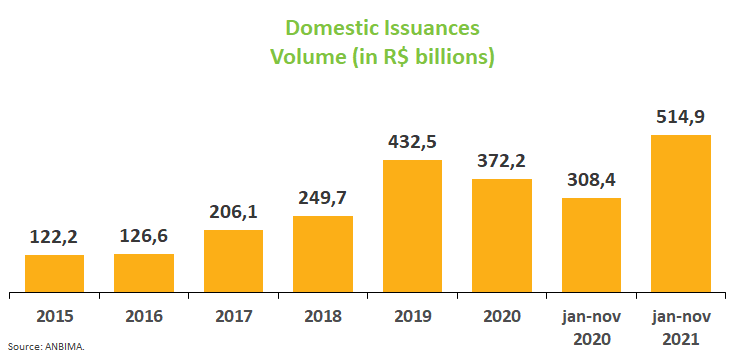

Fundraising tops R$500bn through November

Capital markets offerings raised R$57.9 billion in November, up 54.3% from the previous month. In the year, the total raised reaches R$514.9 billion, 67% above from the same period in 2020. Under review and ongoing offerings amount to R$13.8 billion.

Debentures kept their leading role as the instrument attracting the biggest chunk in the segment, with R$38.1 billion raised in November, or 66% of the amount placed in the month. This move was driven by Brazil’s current monetary tightening cycle, with potential further increases in the Selic rate until at least the first half of next year.

Top holders are still intermediaries and other participants involved in offerings (43.7%), followed by investment funds (39.3%), whose share has been increasing amid more appealing fixed-income assets throughout the year. The largest allocations of proceeds were to working capital (31.8%) and refinancing of liabilities (23.2%).

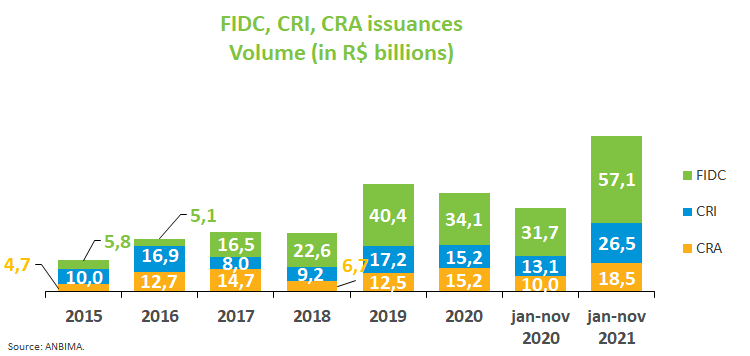

Despite having much smaller shares in the total raised in November, other fixed-income assets performed well from a year ago. CRAs (Agribusiness Receivables Certificates) raised 84% more, jumping to R$18.5 billion from R$10 billion in the same period in 2020. CRIs (Real Estate Receivables Certificates) doubled the volume raised (to R$26.5 billion from R$13 billion) while FIDCs (Credit Receivables Investment Funds) saw an 80% increase (to R$57 billion versus R$32 billion). Their performance is significant in a period of high volatility and steep increase in interest rates.

In equity, issuances totaled R$3.2 billion, focused on follow-on offerings. In the year, share offerings raised R$128.4 billion, or 25% of the total.

There was only one transaction overseas, a $1 billion bond issuance. In the year, international offerings amount to $25.4 billion, including bonds and equity.