Fundraising totals R$253bn in first half

Fundraising in the capital markets reached R$53.6 billion in June, bringing the total raised in the first half to R$253 billion, up 65% from the same period last year.

Once again, debentures stood out and accounted for 38% of the total raised in the month, reaching just over R$20.3 billion and totaling R$99 billion in the year, more than double from the first half of 2020 and equivalent to 82% of the total raised by debenture sales last year.

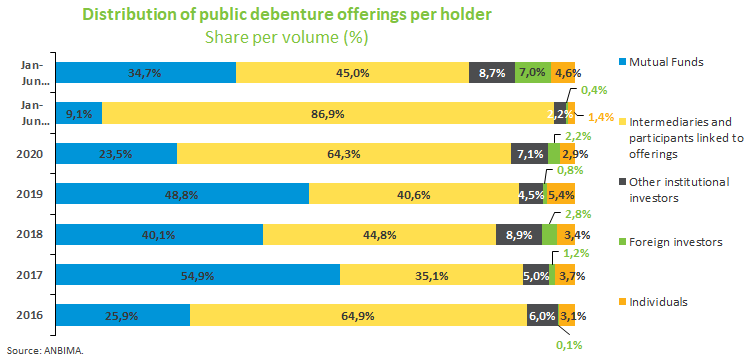

Working capital and refinancing of liabilities accounted for 50.8% of funds raised through debentures, followed by infrastructure investment (19.7%). There were significant changes in the distribution of assets by holder compared with the same period last year. In the first half, intermediaries and other participants linked to issuances, which previously accounted for 86.9%, held 45% of such debt, followed by mutual funds, which jumped to 34.7% from 9.1% in the first six months of 2020. There was also a significant increase in the participation of foreign investors, who already accounted for 7% of subscribers in the first half compared with only 0.4% a year ago.

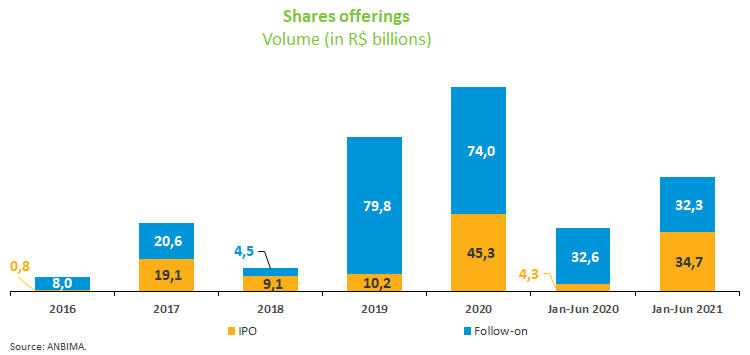

Share offerings confirmed their growth trend indicated in May and had a strong performance, raising R$20 billion in June, of which R$9.6 billion through IPOs and R$10.5 billion with follow-ons (secondary stock offerings). Equity assets already raised R$68 billion in the year through June, an 84% increase from the first half of 2020. Mutual funds (46.4%) and foreign investors (34.8%) are still the largest equity subscribers, with no relevant changes in the percentages from 2020.

Real estate funds kept this year’s average fundraising and reached R$5.8 billion in June, increasing the year-to-date amount to R$26.8 billion in the first half, surpassing the R$18.5 billion from the same period in 2020. In turn, FIDCs scaled back and raised R$3.1 billion in June, about a third of the funds attracted in the previous month, but the total in 2021 already reaches R$31.2 billion and virtually matched the amount raised through such offerings in 2020.

As for the international market, $5.65 billion were raised through bond sales alone, the highest monthly figure so far this year. Petrobras, with $1.5 billion and JBS, with $1 billion, accounted for the largest issuances.