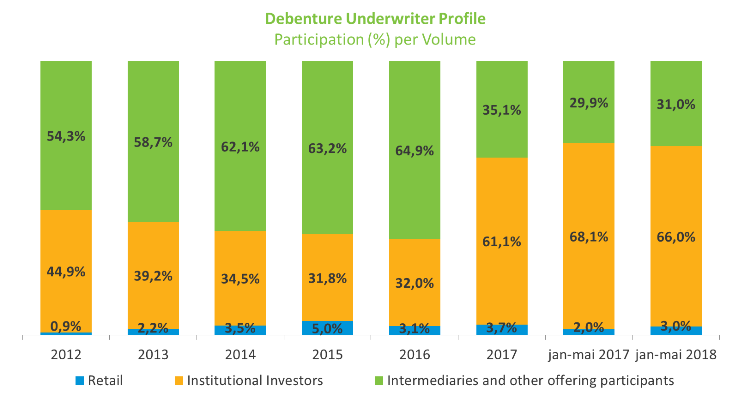

Institutional investors account for 66% of debenture offerings in 2018

In May, the higher volatility of financial indicators increased investors’ risk aversion and shrank transactions in the capital markets. The most used asset in May were debentures, with a R$3.3 billion volume, followed by Real Estate Investment Funds, which raised R$2.3 billion. No offerings were carried out on the stock market, a different picture from April when the first IPOs of 2018 took place. The volume raised in May showed a significant reduction in relation to April, totaling R$8.2 billion compared with the R$26.3 billion in the previous month, mirroring the deteriorating business environment in the period.

The monthly volume of debentures issued did not surpass that of May 2017, which saw offerings totaling R$4.9 billion. Among the total of 11 transactions, all through CVM Instruction no. 476, the highlights were the bond offerings of industry and commerce Cálamo, which raised R$700 million; and of transport and logistics Concessionaire of Lines 5 and 17 of the São Paulo subway system, with R$600 million. As for infrastructure bonds, the year-to-date amount issued reaches R$8.2 billion compared with R$1.8 billion in the same period of 2017.

In the January-May period, the distribution of debenture offerings per holder shows that 66% of the total is in the hands of institutional investors, slightly lower than the 68.1% share in the same period last year. Since 2017, institutional investors have outnumbered institutions and other participants linked to the offering, as the latter historically always held the largest chunk of the volume offered. This trend reflected the greater risk appetite of institutional investors in their search for higher returns in reaction to the significant decline of the Selic rate.

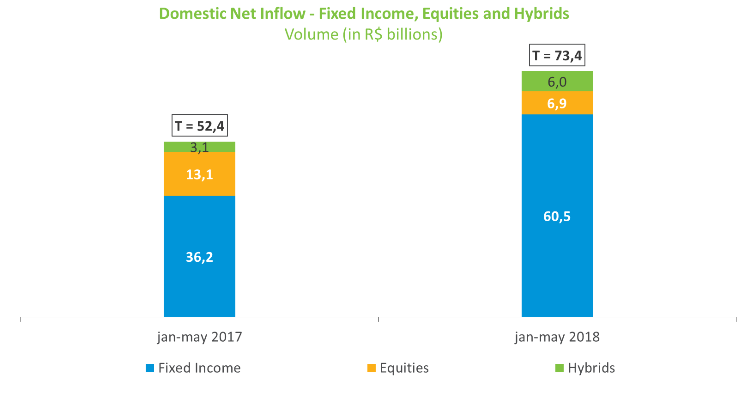

Corporate domestic fundraising up to May already amount to R$73.4 billion compared with R$52.4 billion in the same period of 2017. Of this amount, R$60.5 billion were raised through fixed-income instruments; R$6.9 billion with share offerings; and R$6 billion with Real Estate Investment Funds. In the foreign market, also up to May, financing transactions reached R$38.9 billion, lower than in the same period in 2017 (R$53.3 billion). In this case, all the volume raised overseas so far in 2018 has been through fixed-income assets.