IPOs raise R$ 18.8bn and stand out in March

Issuances in the capital markets raised R$ 53.1 billion in March, up 93.8% from the previous month. In the first quarter, the total issued was R$ 102 billion against R$ 83.8 billion in the same period in 2020, a 21.8% increase.

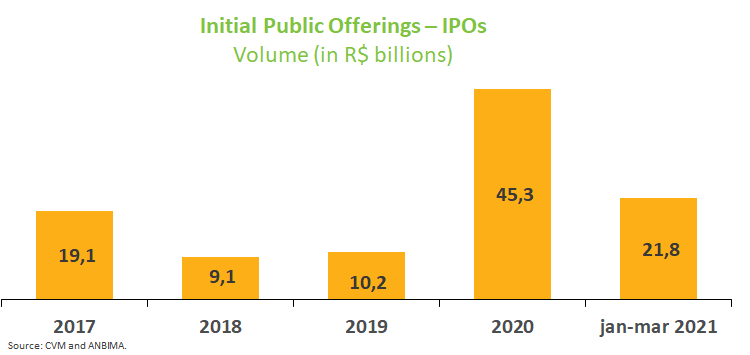

The highlight was the significant volume of initial public offerings, which totaled R$ 18.2 billion, the best monthly result in the historical series and accounting for the lion’s share of the amount raised in March at 35%. The figure represented all equity transactions in the period since there were no follow-on offerings in the month. The volume raised from January through March reached R$ 21.8 billion, which already corresponds to 48% of IPOs in the entire 2020. The ongoing offerings and under review (except stock offerings) totaled R$ 6.2 billion and R$ 10.4 billion, respectively.

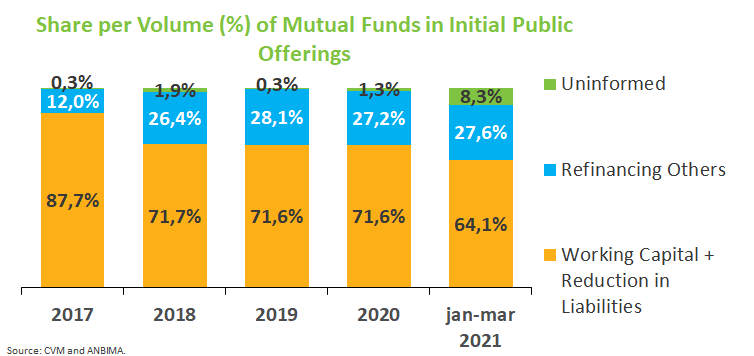

In the first quarter, mutual funds were still the largest equity underwriters, with 49.7% of the volume placed, followed by foreign investors, with a 34.2% share. Most proceeds raised through primary offerings were allocated to the acquisition of assets and operating activities - 58.8% from 17.7% in the first quarter of 2020. Equity purchases accounted for 25.4% of the total.

In the fixed- income market, debentures raised R$ 14.3 billion, up 12.8% from February. The total raised in the first quarter reached R$ 40 billion, almost the double from the R$ 16.8 billion between January and March last year. Debentures accounted for 27% of the total issued in March, only behind IPOs.

From the total issued through debenture sales, 64.1% went to working capital and refinancing liabilities (including repurchase or redemption of debentures previously issued), while about 24.9% of the funds were allocated to investments in infrastructure. Most of the proceeds went to intermediaries and other participants linked to offerings, who held a significant 62.9% share of placements, followed by mutual funds, with 24.7%.

Real estate investment funds raised R$ 6 billion, more than three times the amount in February (R$ 1.4 billion) and confirming the segment’s good momentum. Real estate investment funds raised R$ 14 billion in the year to March, up 29% from the first quarter in 2020.

Only one transaction was performed in the foreign market, a $ 1 billion debt issuance, bringing the total raised from January through March overseas to $ 8.3 billion, down from the $ 9.5 billion in the first three months last year.