Local market issuances rise 21% in January to R$ 19bn

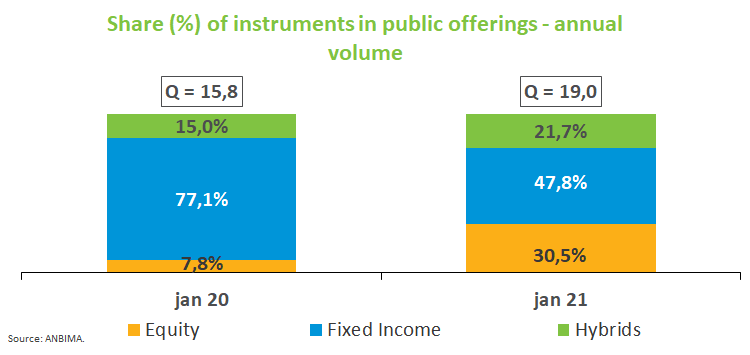

The capital market raised R$ 19 billion in January, a 20.7% increase from the same period last year, when the amount totaled R$ 15.8 billion. Ongoing offerings and under review amounted to R$ 10.4 billion and R$ 7.6 billion (excluding share sales), respectively.

Share offerings led transactions, raising R$ 5.8 billion and accounting for 30.5% of the January total. Of that amount, R$ 5.3 billion were follow-ons (secondary share offerings) and R$ 486 million were raised through initial public offerings. Among offerings under analysis, there are 42 IPOs in the pipeline, a sign that the stock market rally is likely to remain in 2021.

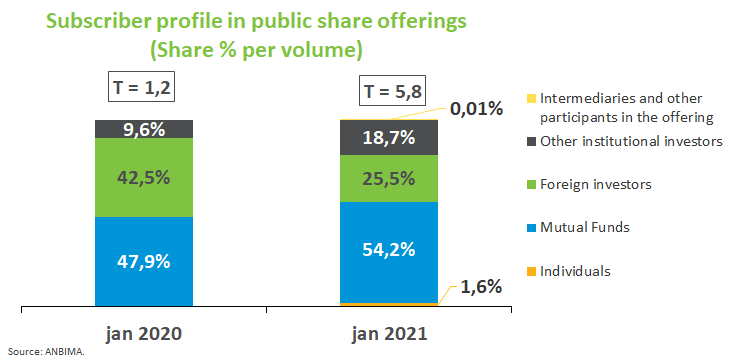

Mutual funds were the largest equity subscribers, with 54.2% of the amount placed, followed by foreign and institutional investors with 25.5% and 18.7%, respectively. As for proceeds allocation, there was a significant profile change. In January 2020, 100% of proceeds went to refinancing liabilities while in this year the category accounted for only 32.1%. Most of the amount raised (61.6%) was targeted to asset acquisitions and operational activities.

Debentures accounted for 21% of the January volume, raising R$ 4 billion or 37.2% below the same month in 2020 (R$ 6.4 billion). Intermediaries and other participants in the offering bought most part of the placements in public offerings, with 86.0%, followed by 10% from mutual funds. Most of the funds raised were allocated to refinance liabilities (43.7%).

Real estate investment funds continued showing their positive performance seen since 2018, with R$ 4.1 billion raised last month, up 74.5% from January 2020 (R$ 2.4 billion).

Issuances abroad raised $ 5.2 billion last month against $ 5.7 billion in January 2020. Of that amount, $ 4.7 billion were raised through debt sales and $ 512 million in share offerings, including stocks sales carried out overseas, a type of transaction that ANBIMA now includes in its statistics on international funding.