The 5th edition of the X-Ray of the Brazilian Investor brings news. This year, for the first time, we included the D/E class in the survey and also brought new points of view. In addition to gender, we investigated the financial behavior of Brazilians by race, sexual orientation and generation.

Once again, the survey was carried out in the middle of the pandemic and it is possible to see how it directly impacted employment and income. More than half of Brazilians (62%) had a total or partial loss of income. In addition, 54% of people needed money for an emergency. The way out? Redeem part of the investments, request a loan, or get rid of some assets. When it comes to expectations, the increase in interest rates is one of the factors that most positively impact the intention to invest. Another good news is that, for 2022, the expectation is that there will be new entrants in the investment world. Check out the main highlights of the survey below.

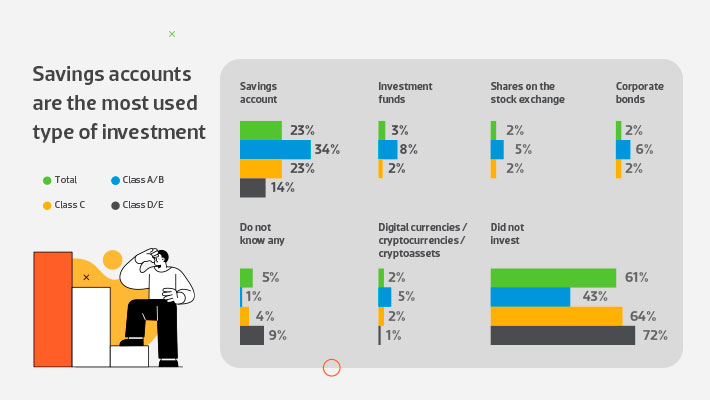

INVESTMENT AND ATTITUDE A third of Brazilians invest in financial products, especially the A/B class. Savings accounts remain the favorite, with 23% of the population investing in them. But there is room for new products: cryptocurrencies accounted for 2% of investments made in 2021 – they are most popular among Gen Z and Millennials – tied with government bonds, stocks, and private bonds.

The return on these investments is generally destined for home ownership (29% of the population). Brazilians also intend to keep the money saved or invested (20%) and invest in their own business (8%).

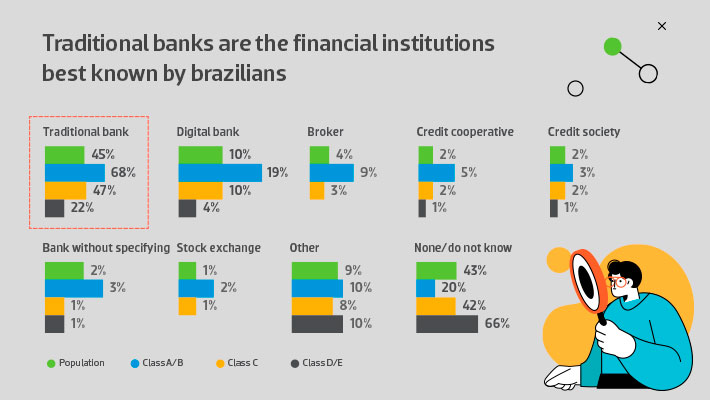

KNOWLEDGE ABOUT INSTITUTIONS For the first time, we measured the knowledge of Brazilians (investors and non-investors) about financial institutions. When asked which types they know, they spontaneously cited more than one institution. The most remembered were traditional banks (45%), followed by digital banks (10%) – which are most mentioned by Gen Z and Millennials.

The social class of respondents influenced the results: the lower the social class, for example, the lower the awareness of digital banking. Attention was drawn to the investors’ lack of familiarity with the topic: 26% did not spontaneously mention any institution.

When we talk about investment products, savings accounts are the best known among people of all social classes. Next, there are stocks, investment funds, and government and private bond.

IN THE AGE OF INFORMATION Digital channels are disseminators of finance content and have more appeal among Gen Z and Millennials. Among investors using these channels, they prefer YouTube (32%), followed by television (29%) and Instagram (22%).

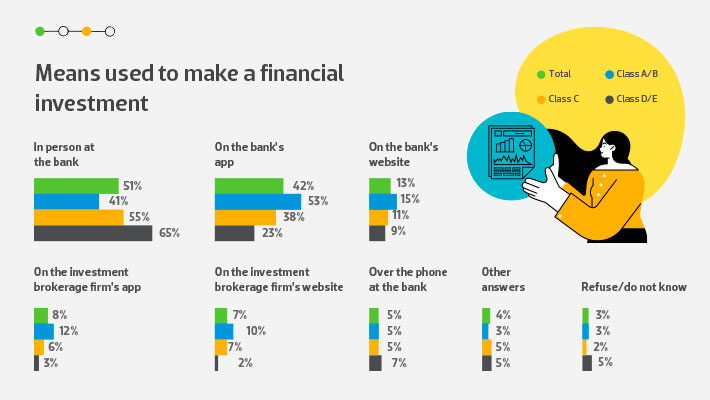

When making an investment, going to the bank in person is still the most used method by 51% of the population --this universe comprises mainly the D/E class and people from generations X, Boomers, and above 76 years old--, followed by the internet: bank apps are used by 42% of people and websites by 13%.

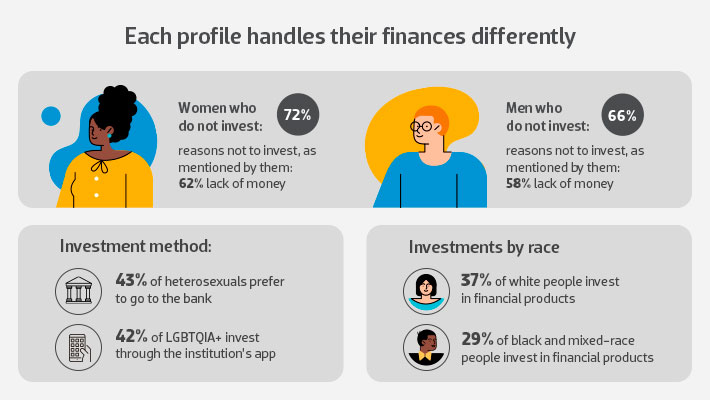

DIVERSITY Investor behavior can change according to gender, sexual orientation and race. Diving into this detail is a way to see how each profile handles their finances and adapt, if necessary, to meet each of them more efficiently. Regarding gender, we found that women invest less than men. The main limitation pointed out by 71% of them is the financial conditions – for men, this percentage corresponds to 62%. LGBTQIA+ and heterosexual audiences see security and emergency reserve as advantages of financial products, but they think differently when using the money invested.

While 40% of LGBTQIA+ want to fulfill the dream of owning their own home, the share of heterosexuals with the same desire is 28%. Another difference is the means used to make investments: heterosexuals prefer to go to the bank in person (43%), while LGBTQIA+ invest through the institution’s app (42%).

There are also differences in the way of investing when it comes to black, mixed-race and white people. Among white respondents, 37% invest in financial products. In the group of black/mixed-race respondents, they add up to 29%. Regarding Brazilians who do not save money, the proportion of black/mixed-race people is 63% and white people is 56%. Social and economic aspects largely explain these differences.

PREVIOUS SURVEYS