Quick access:

Quick access:Introduction

The fourth edition of the “X-Ray of Brazilian Investors” survey takes on a unique character because of the period it portrays. The year 2020 was marked by the coronavirus pandemic, which changed the world and impacted business as well as income and consumption dynamics, among many other aspects. Coupled with this is the scenario of low interest rates that prevailed throughout the year.

The pandemic changed people’s habits, brought about a loss of income for a portion of the population, and led another portion to spend less. In 2020, the number of investors fell for the first time since the survey has been conducted. The downturn was driven by a pull-out from investments on the part of class C. Also, for the first time, fewer people were putting money into savings accounts, while all other financial products were more widely used.

The X-Ray of Brazilian Investors, in partnership with Datafolha, is now in its fourth edition. On the following pages you will get to know the survey featuring the main data from 2020, gathered in November and December, through 3,408 interviews and covering all five regions of Brazil. Click here to download the full report.

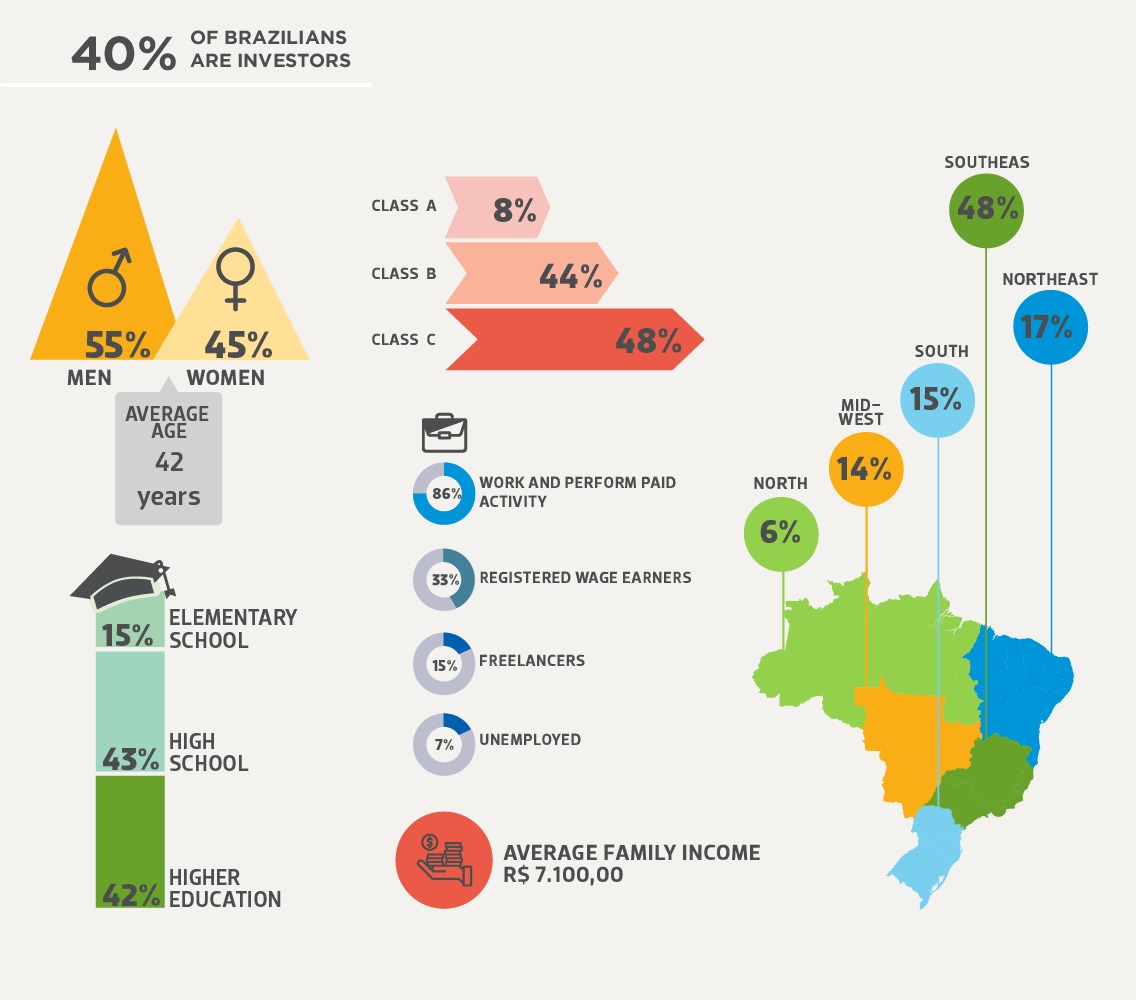

WHO ARE BRAZILIAN INVESTORS

In the total sample of the Brazilian population, we find people who invest in financial products and another portion that steers their financial resources toward home ownership, education, or their own business. For the purpose of this survey, we separated the people that invest in financial products. The investor profile is outlined based on this portion of the populace, which corresponds to 40% of the sample.

See the profile summary in the table below:

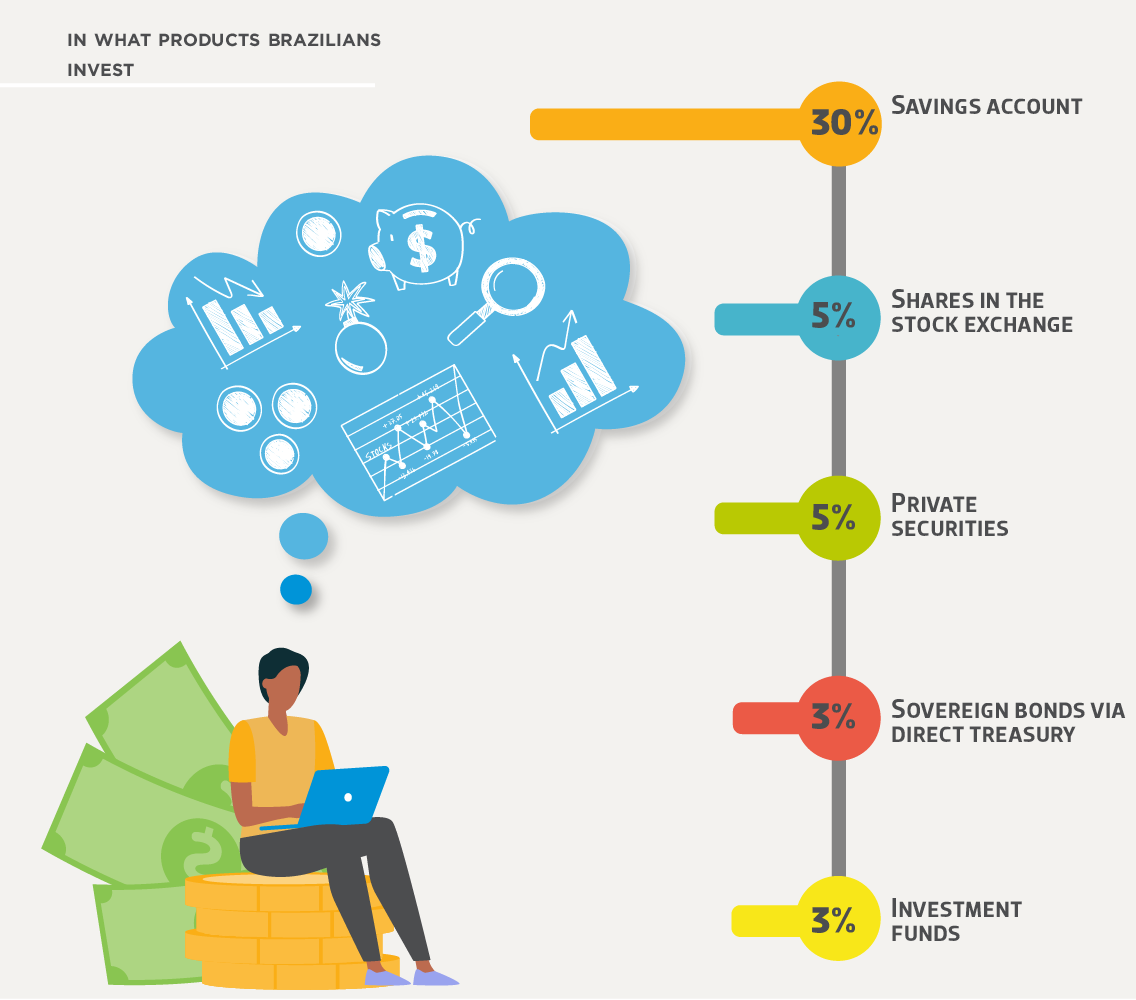

WHAT DO BRAZILIANS INVEST IN?

Brazilians are increasingly using financial products as an investment option. Stocks, private securities and mutual funds represented a greater share in investors’ portfolios in 2020, while savings accounts lost ground for the first time in four years, since ANBIMA began carrying out surveys of the economically active population in classes A, B and C nationwide.

Among Brazilians who invested in 2020, 53% of them put their money in financial products. For the first time, financial products surpassed the sum of all other destinations for people’s surplus cash, reaching an estimated population of 20 million Brazilians.

HOW BRAZILIANS HAVE BEEN ABLE TO SAVE

Reduced spending on travel, parties, bars and restaurants favored the formation of involuntary savings by the Brazilian population in 2020. For 56% of people who managed to set aside some money last year, this was the main source of savings. A year earlier, prior to the pandemic, only 34% of people who saved money mentioned a reduction in such expenses as the source of savings. This means that, while in 2019 around 12 million Brazilians said they saved due to spending cuts, in 2020 the total jumped to more than 20 million people.

The impact of the pandemic (and the consequent social distancing) on how Brazilians saved money was so significant that 7% of them – or roughly 2.5 million people – said they saved money because they “had nowhere to spend it”. See the table below.

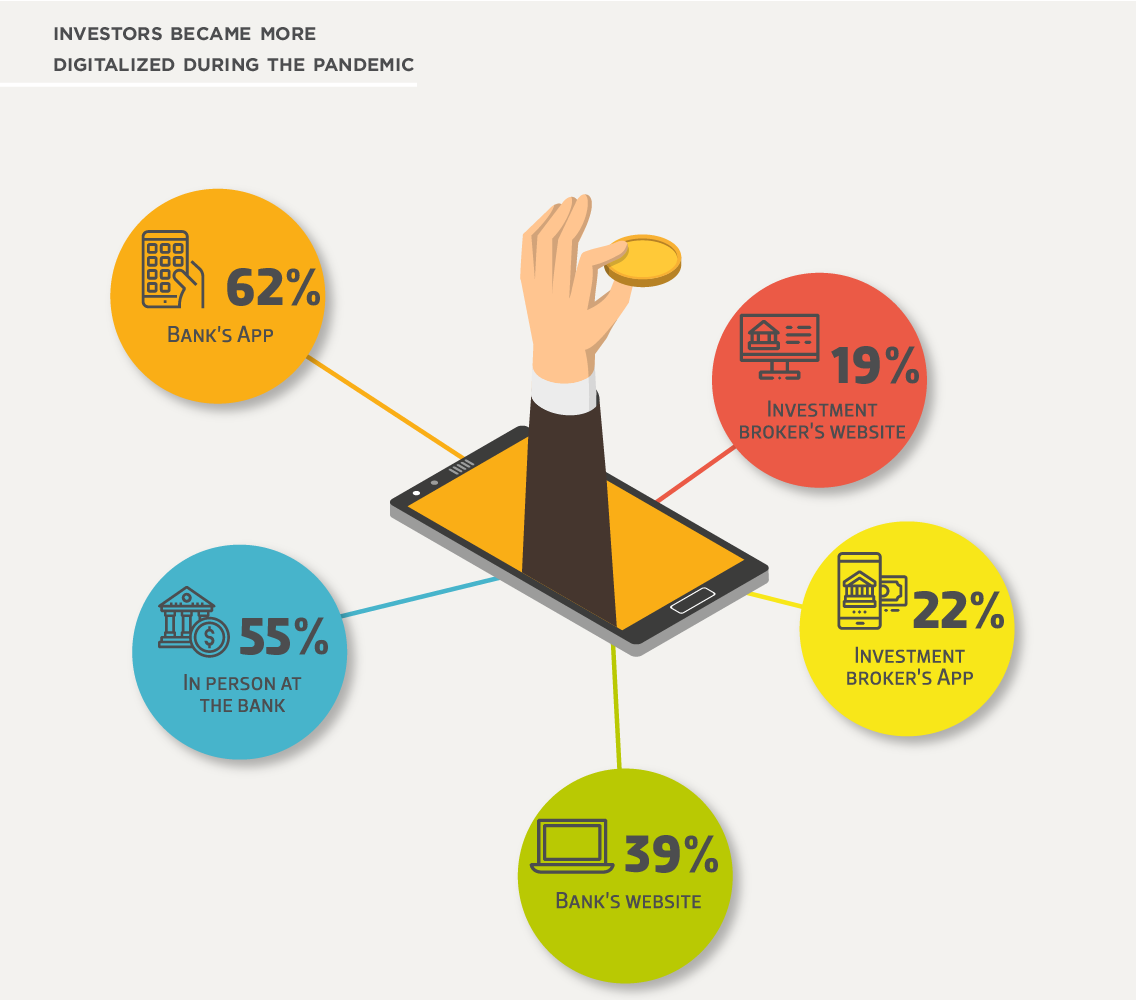

INVESTORS BECAME MORE DIGITALIZED DURING THE PANDEMIC

Digital media gained ground when it comes to making investments. In 2020, also for the first time, banks’ apps were the most commonly used solution, surpassing in-person visits to the bank, which had led the survey in the two previous years. Use of bank apps more than doubled in 2020, from 30% to 62% in terms of people’s preference as a means for making financial investments. In-person visits to bank branches fell from 71% in 2019 to 55% one year later.

All other forms of distance investing also showed significant growth, such as websites of banks or brokers, and over the phone as well.

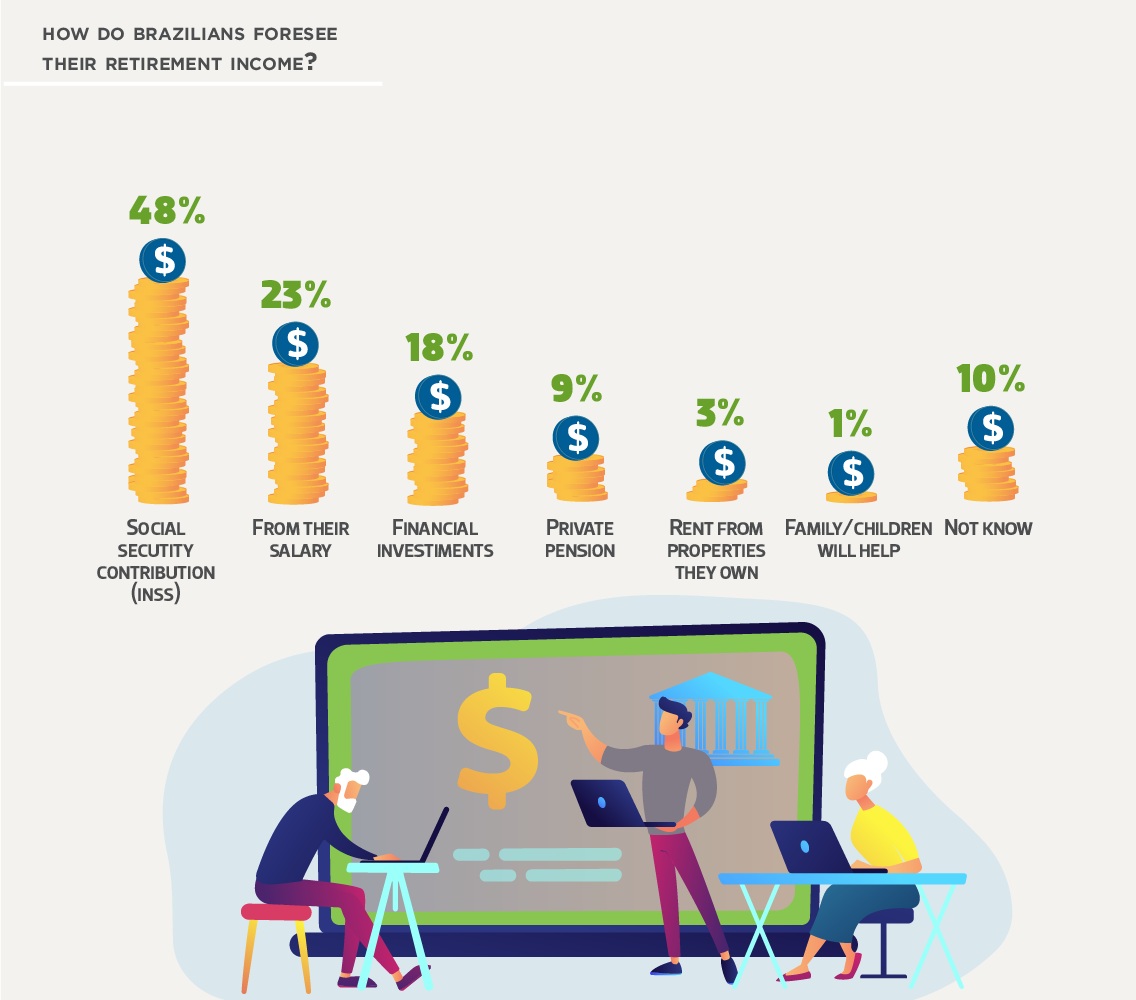

Retirement

The number of people who expect to count on financial investments plus their own salary to comprise their income after retirement has been growing, while the proportion of those who expect to have resources from Brazilian Social Security (INSS) has been decreasing.

The survey also identified that there is a major difference in perception between retired and non-retired people when it comes to their financial life. While those who have already retired admit that their standard of living has worsened and their spending has increased, those who are still professionally active tend to project a better financial life, with stable or even decreased spending.

PREVIOUS SURVEYS