X-Ray of the Brazilian Investor – 2nd Edition

See the new edition of the survey and discover the Brazilians investment habits

The second edition of the survey X-Ray of the Brazilian Investor carried out with Datafolha’s support, outlines the savings and investment habits of Brazilians from the North to the South of the country.

The study with data from 2018, collected through interviews with 3,400 people, presents several findings about the behavior of investors and the population when it comes to money, in addition to comparing the data with those of the first survey, released last year.

Here you will find the most important, comparative data between the two studies conducted to date and the main materials that came out in the media. To check the survey in full and learn all about it, download the full report and see the full data.

Highlights In 2018 the percentage of Brazilians who had some balance in investment products remained at 42% - the same percentage of last year's survey.

However, the survey shows that of the 33% of Brazilians who saved in 2018, 48% invested in financial products - in 2017 that percentage was of 42%. The survey also shows that only 23% decided to invest in a new application last year, while 59% invested in the same financial products they had already invested in previous years.

See the Brazilian investors profile below.

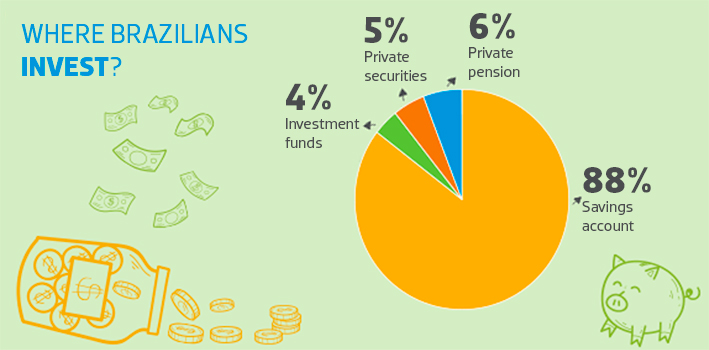

Being the national preference, the savings account is the main destination of Brazilian investors’ economies. The predominant profiles are those aged more than 25, higher education, income higher than two minimum wages and belonging to the Southeast, South and Central West regions (39%). The North and Northeast have very timid participation in investments in general, not only in the savings account.

When the income is exclusively analyzed, 44% of people who receive more than ten minimum wages declare keeping money in a savings account. The percentage drops to 28% of those interviewed who earn up to two minimum wages.

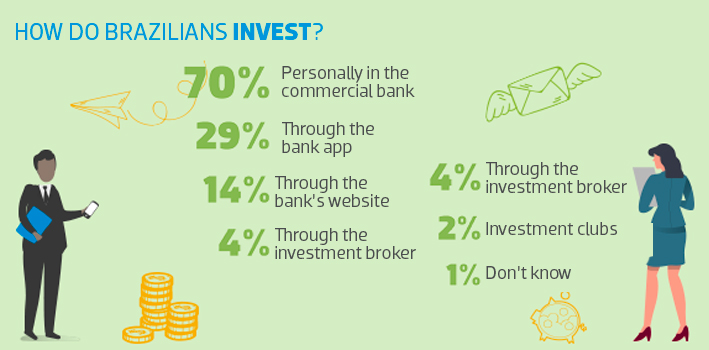

This year's survey brings a new feature: we asked respondents what media they use to apply their money. And the result was that 70% of Brazilians investors prefer the traditional way of personally going to the bank to carry out their applications.

There are those who prefer the convenience of technology in their favor, 29% take advantage of the market modernization and use banking apps and 14% turn to bank websites - those who prefer to apply in this way are concentrated in the A / B classes and earn more than five minimum wages.