We extended an invitation to institutions operating on the Brazilian capital market: can we talk about sustainability? The topic is certainly not new, but adopting ESG (environmental, social and governance) criteria in investment decision-making processes has been growing vis-à-vis the increasingly visible effects of climate change, environmental tragedies, and social problems. The COVID-19 pandemic has reinforced the urgency of this matter. But, when we talk about sustainability, is everyone on the same page?

To answer this question, we took a step back and set out to get to know the market’s understanding of this topic, and institutions’ stage of maturity in this regard. We interviewed asset management firms, banks, brokers, and distributors, among others.

In this section, you’ll find the main highlights of this survey, which was supported by the consulting firm Na Rua (qualitative phase) and by Datafolha (quantitative phase). To delve deeper into the topic, you can download the full report.

-

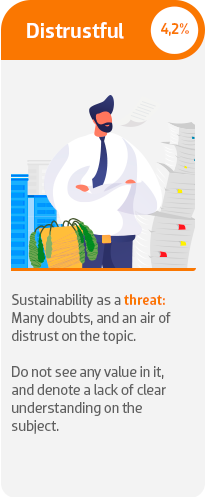

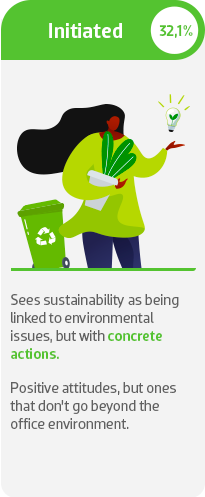

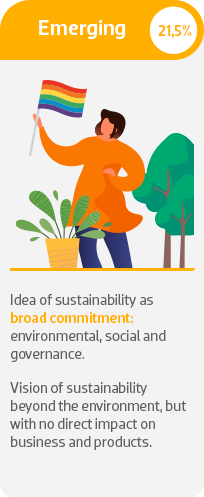

MARKET PROFILES We identified an unprecedented overview of how ESG is seen and addressed in the Brazilian capital market. Five behavior patterns were recognized, based on their positioning and understanding on the topic.

-

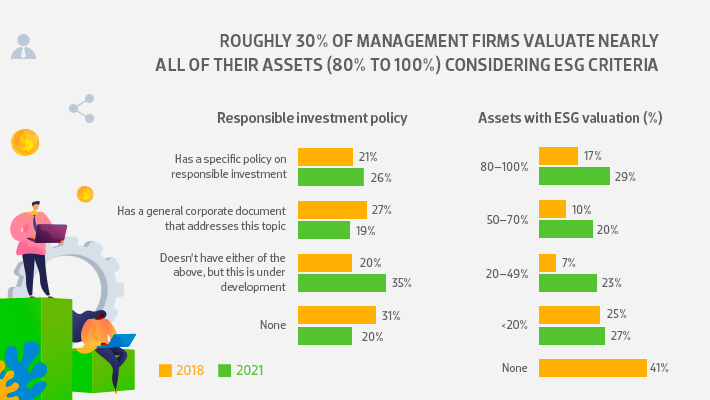

ZOOMING IN ON ASSET MANAGERS When we look only at asset managers, there is an overall evolution in the processes and policies, despite a still sluggish growth. Compared to our 2018 survey, the percentage of assets analyzed through the ESG lens has increased, and more institutions have a responsible investment policy.

-

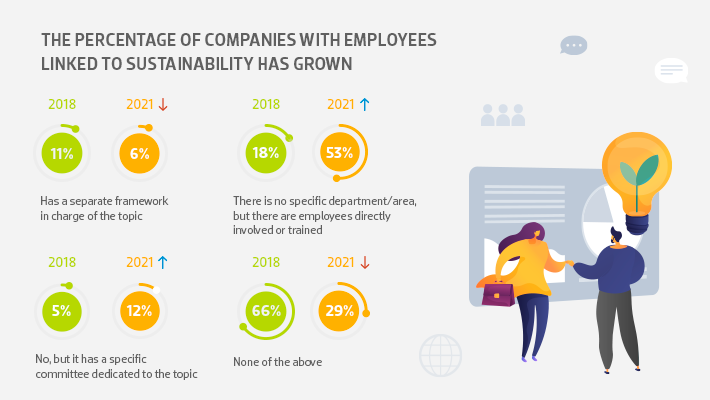

Who calls the shots? At most of the management firms interviewed, there is still no exclusive department or area for dealing with sustainability. Only 6% have a dedicated framework for this, but 53% have staff members directly involved with the issue; on average, each management firm has five such employees. ESG commitments are led by the Compliance & Risk department at a notable 44% of these firms..

Na fase qualitativa da pesquisa, chama atenção o fato de que a maioria dos funcionários escolhidos para responder sobre o tema sustentabilidade nas empresas eram mulheres.

GREATER RELEVANCE For 87% of survey respondents, the topic has gained more relevance in the last 12 months. One of the possible reasons is the pandemic, which changed the risk perception at institutions. But this shift is not expected stop there: nearly all the firms (90%) believe that sustainability will be even more relevant to the capital market in the next 12 months.

-

DOWNLOAD

Your subscription could not be validated.Thanks for downloading our report!