Fund industry shows record net inflow in first half

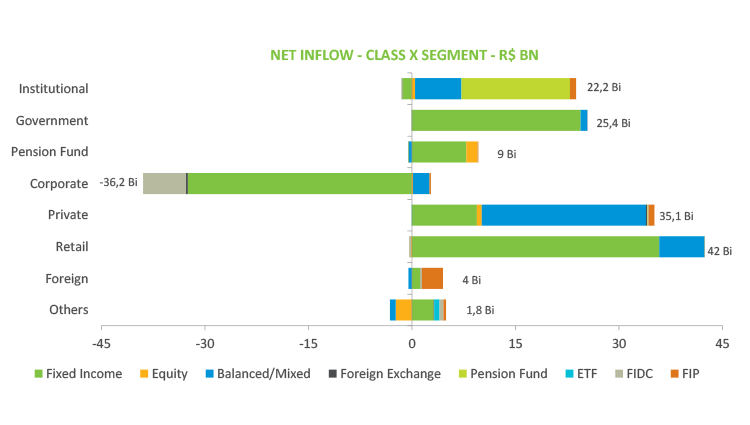

Net capital inflow in the fund industry totaled R$113.6 billion in the first half, the highest amount since the beginning of the historical series in 2002. The volume rose 156% compared with the first half of 2016, when the segment had net inflow of R$44.3 billion.

Of the amount raised, Fixed Income (R$57.5 billion) and Balanced/Mixed (R$39 billion) investment funds accounted for 85% of allocations. Information per investor type is available only up to May, but it is noticeable that individuals in the private and retail segments carried out most of the allocations in these funds. In the case of private clients, 68% of the funds went to the Balanced/Mixed class, while 85% of allocations from retail were invested in fixed-income funds.

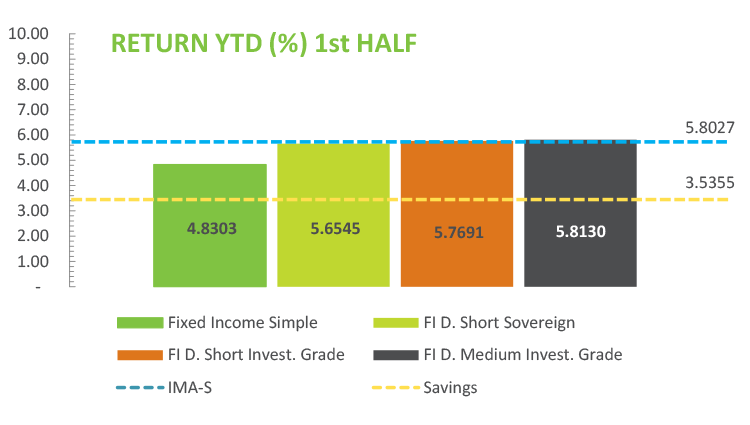

The uncertain environment in the first half of 2017 favored returns of funds with a shorter-term portfolio, especially those with fixed income. Among those with more significant AuM, portfolios of Medium Duration Investment Grade and Short Duration (investment grade and sovereign bonds) posted the best performances, with returns higher than savings and very close to that of LFTs portfolio in the market — reflected in the trajectory of the IMA-S. Long-term funds — Long Duration Investment Grade and Free Duration Investment Grade and Sovereign — were outperformed by fixed-rate bonds in the market (IRF-M) and were in line with the yields of the NTN-Bs (IMA-B), medium and long-term securities.

The perception that the market will still experience volatility periods in the coming months makes the scenario challenging to accommodate investors’ risk-return expectations in the segment. The maintenance of diversified portfolios, with specialized management and transparency in business strategies, will be a necessary condition to repeat the fund industry’s positive performance in the first half.