May outflow does not reverse fund industry’s growth trend in 2018

In May, the fund industry’s net outflow of R$4 billion mirrored the performance of the main market segments in the period -- stock market, interest rates and foreign exchange. The necessary adjustments in asset prices in response to an outlook of greater uncertainty incurred losses in funding and yields of top portfolios without, however, reversing the industry's positive trajectory in 2018. It is worth mentioning that significant withdrawals of two funds alone (R$9 billion) reinforced this trend.

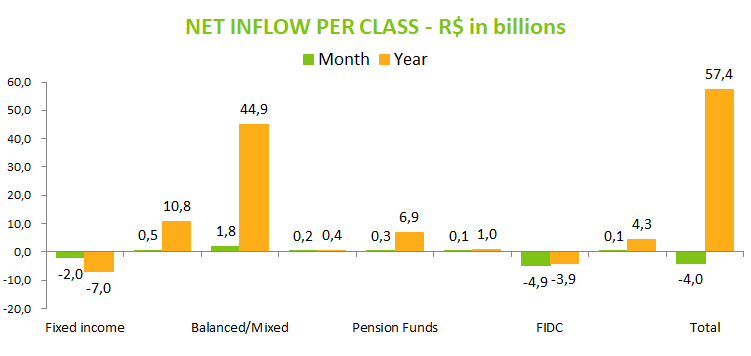

As for the May figures, the largest outflow was seen in the FIDC class -- R$4.9 billion --, while a large portion of this amount reflected a withdrawal of a single investor. Fixed-income funds showed a R$2 billion outflow, while Balanced/Mixed funds -- which are more exposed to risk -- saw net inflow of R$1.8 billion. Equity funds went in the same direction with net inflow of R$470 million. The asset allocation within the industry suggests investors are migrating to portfolios with less risk exposure. The Fixed Income Short Duration - Sovereign class raised R$8.9 billion, the best result among all the fund industry’s types, while the Balanced/Mixed - Free type saw a R$8.3 billion outflow. It is worth mentioning the amount raised in May by the Balanced/Mixed - Macro class, of R$3.4 billion, maintaining its positive trajectory throughout this year.

The fund industry’s outflow in May did not reverse its positive trend this year, still showing net inflow of R$57.4 billion. The Balanced/Mixed type accounts for a good chunk of this amount, with inflow of R$44.9 billion. The Balanced/Mixed - Macro and Free types were the highlights, with net inflow of R$19.3 billion and R$8.3 billion, respectively. Equity funds accounted for R$10.8 billion year to date up to May, most notably in the Equity Active Index (R$4.4 billion) and Equity - Free Portfolio (R$3.7 billion). As discussed in previous editions of this report, these figures mirror investors’ willingness to seek greater exposure to risk so that they can reap more attractive returns in a context of low interest rates. We point out that the R$23 billion redemption from a single fund this year has compromised the performance of fixed-income funds, which encompass more conservative strategies. In the January-May period, this class of funds saw a R$7 billion outflow.

The resource allocation data by segment up to April reinforce this perception. The amount allocated to the Balanced/Mixed class by retail (retail and high-income retail) and Private investors continues above the volume invested by those agents in the fixed-income fund class: R$23.5 billion versus R$6.9 billion.

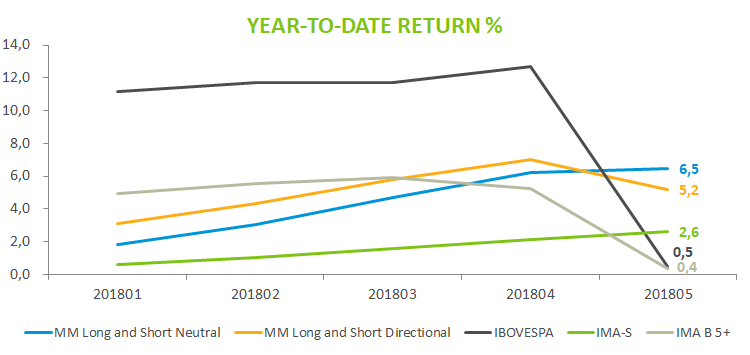

Investment fund’s yields in May were in line with the negative performance of market indicators -- the IMA-General fell 1.43%, highlighting the 4.65% decline of the IMA-B 5+, while benchmark stock index Ibovespa dropped 10.87%. All types of Equity funds had monthly losses, while in the fixed-income class the positive highlights were the Short Duration (Sovereign and Investment Grade) types, with returns of 0.41% and 0.49% respectively. Among the most representative Balanced/Mixed types, Macro and Free funds had monthly negative returns of 1.56% and 0.98%, respectively. In the year to date, the Balanced/Mixed Long and Short types (Neutral and Directional) have outperformed the top market benchmarks, with returns of 6.46% and 5.15%, respectively.

The Equity - Free Portfolio, which has the largest assets, is up 0.34% in the year to date. In this class, the best performances are seen in the Equity-FMP-FGTS (28.2%) and Single Equity Funds (19.44%). In fixed-income funds, the Fixed Income Long Duration -- Investment Grade shows the highest return so far in 2018, with 3.46%.