Companies expand domestic offerings in March

Brazilian companies increased domestic funding in March. The transaction volume has been recovering since early in the year, slightly surpassing the positive results of 2017. In March alone, funding in the local market reached R$12.7 billion, the highest monthly amount in 2018, and a 30.4% increase compared with the same month of 2017.

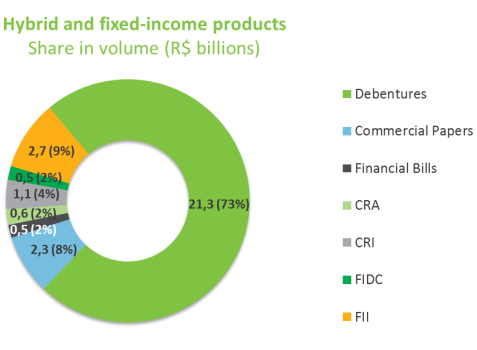

The fixed-income segment was the companies’ favorite in the period, reflecting the impact of the decline in the base interest rate on corporate capital structure. Debentures were the most used assets in March, with total turnover of R$9.3 billion. Commercial papers came in second, raising R$1.3 billion, followed by CRAs and CRIs, with totals of R$610 million and R$593 million, respectively. In March there were four transactions through real estate investment funds, classified as hybrid products, which amounted to R$621.55 million. The single equity transaction of the month, and of 2018, was the follow-on offering of Minas Gerais-based utility Cemig, which raised only R$110.7 million. The result reflects the freezing of some stock offerings expected for early 2018 amid increased volatility in the segment and caution from foreign investors, frustrating expectations that share offerings would resume already at the beginning of the year.

March’s top offerings in volume include debenture issues of industrial conglomerate Ultrapar (R$1.7 billion); renewable-energy equipment supplier Xingu Rio Transmissora de Energia (R$1.25 billion); Viaquatro - São Paulo Subway Concessionaire (R$1.2 billion); and telco Claro (R$1.1 billion). Considering issuers who disclosed their allocation of raised funds, most debenture offerings were meant for working capital (34.8%), refinancing liabilities (34%), and infrastructure investment (17.5%).

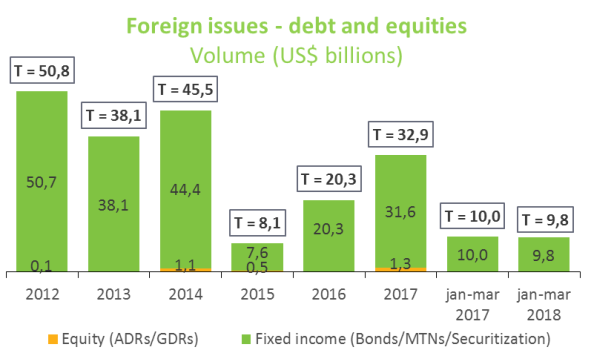

Funding transactions carried out by Brazilian companies abroad slowed down in March, mirroring a global trend, with increased volatility in international markets. The only transaction in March was Itaú Unibanco's bond issue, which raised $750 million. However, the total amount attracted by fixed-income securities ($9.8 billion) in the first quarter is very close to that of the same period last year ($9.95 billion), and accounts for the largest portion of domestic transactions in 2018, with funding equivalent to R$31.5 billion.