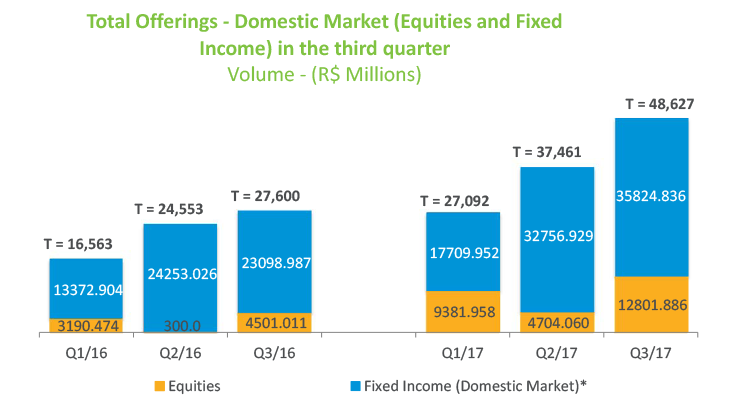

Companies raise R$48.6 billion in domestic market in Q3

Securities offerings in the domestic market totaled R$48.6 billion in the third quarter of 2017. The volume is 29.8% higher than in the second quarter and up 76.2% compared with the same period of 2016, figures that reinforce the perception of recovery in local offerings.

In September alone, local offerings amounted to R$11.5 billion, and were well distributed among different instruments. During the month, eight commercial paper offerings raised R$3.3 billion; three stock sales totaled R$3.1 billion; and 20 issuances of debentures raised R$2.6 billion. Among securitization instruments, the ten CRI offerings (R$1.1 billion) and the three CRAs (R$1.3 billion) were the highlights.

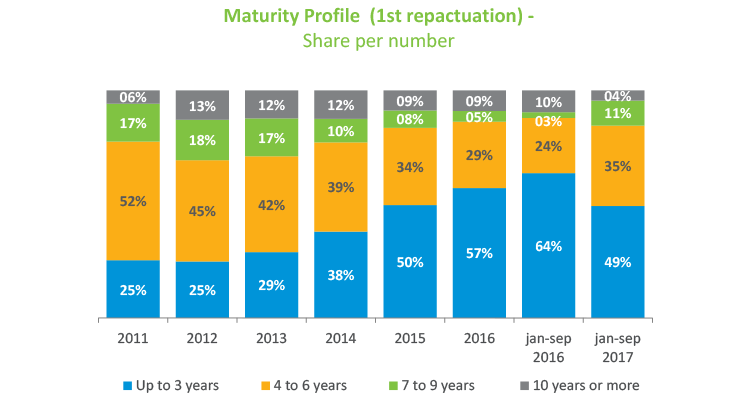

In the year through September, debentures offerings lead transactions, reaching R$50.4 billion, followed by share offerings with R$26.9 billion. Among debentures, it draws attention the increased share of assets with maturities between four and nine years, rising to 46.4% of the total in 2017 compared with the 26.8% from January to September 2016. However, most of the funds (46.2%) were allocated to working capital, indicating that declining interest rates and signs of economic recovery have not yet triggered a fundraising movement to refinance liabilities or investments.

Among stock offerings, foreign investors raised their share among underwriters and accounted for 59.8% of the total throughout the third quarter of 2017. In the same period last year, these investors’ share was at 47.7%. Regarding allocation of funds raised from stock offerings, the majority (55.5%) was spent on acquisition of assets and equity stakes, while 26.9% of the funds were allocated to reduce liabilities, and 17.5% went working capital.