IPOs raise R$6.8bn in April

Equities led corporate fundraising in April. Three initial stock offerings were carried out in the month, raising R$6.8 billion, both with primary issues and secondary offerings of assets. The offerings from Notre Dame Intermédica Participações and Hapvida Participações e Investimentos -- both healthcare insurers -- and from Banco Inter raised R$2.7 billion, R$3.3 billion and R$700 million, respectively, launching the 2018 IPO season. The transactions took place at a positive moment of the stock market, which saw in April its fifth month of gains in a row. The amount raised through IPOs in the year is almost twice the volume seen in the same period of 2017 (R$3.5 billion). However, taking into account follow-on stock offerings, the 2018 figure is still 40% below the amount raised in 2017.

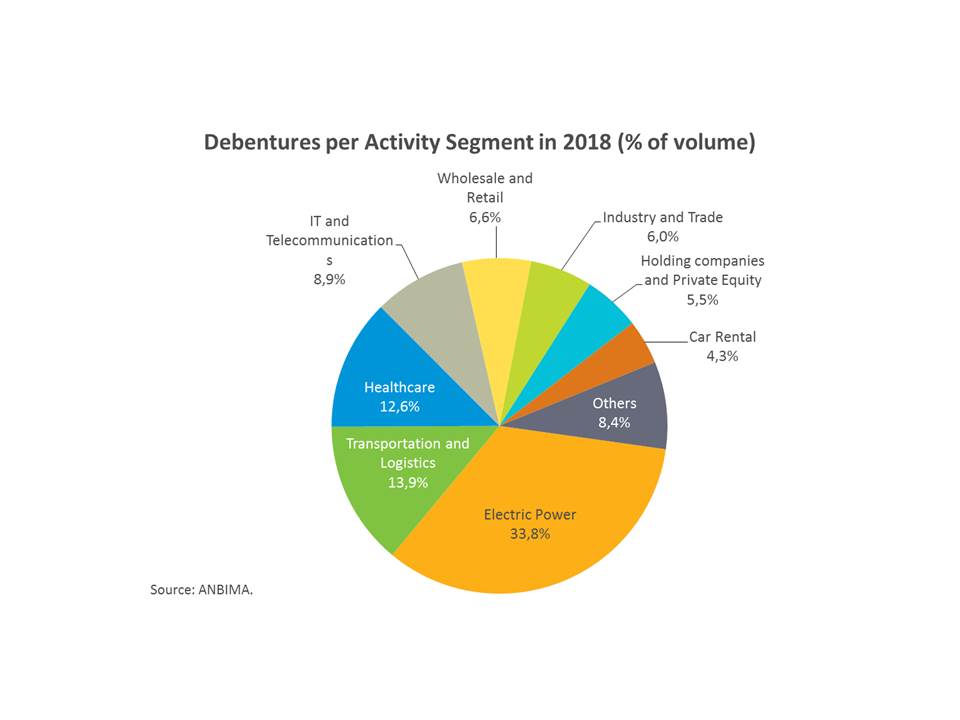

Debentures were the second most used asset in the month, with offerings that raised R$6.7 billion, amount that also surpassed the R$4.8 billion in 2017. The highlights were the bond issues of power utility Centrais Elétricas de Sergipe (CELSE), which raised R$3.4 billion, and of Carrefour’s cash-and-carry chain Atacadão, with R$1.5 billion. In 2018, 15 sectors have already carried out debenture offerings, totaling 59 transactions. Segments that most used the instrument include the power industry, which concentrated 33.8% of the transactions, transportation and logistics and healthcare sectors, accounting respectively for 13.9% and 12.6% of the total volume.

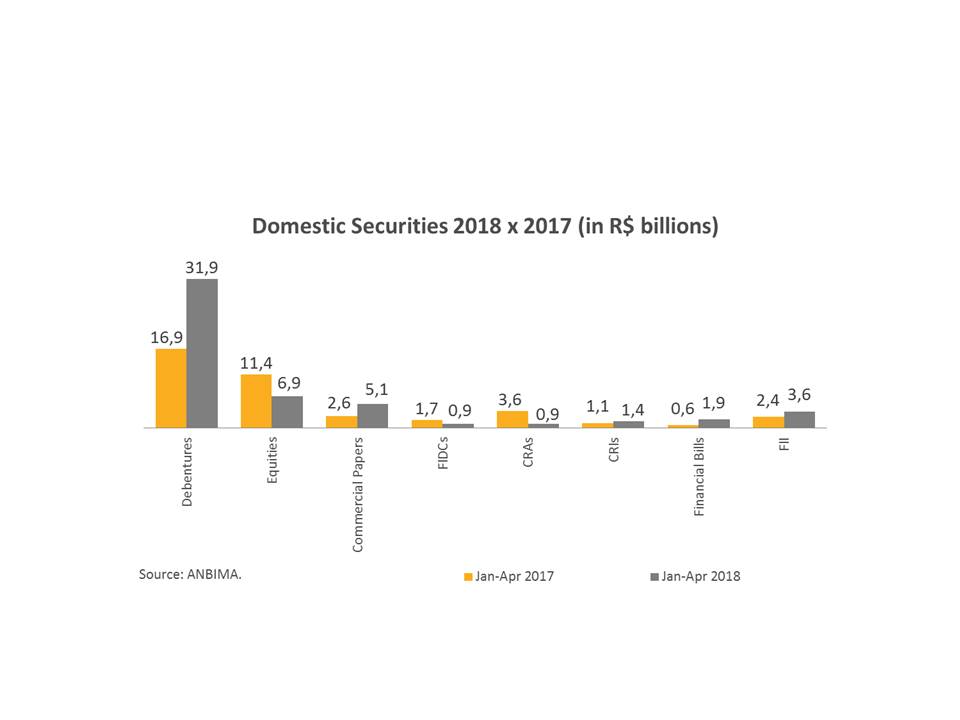

Corporate local fundraising amounted to R$52.5 billion in the January-April period, a significant increase compared with the R$40.3 billion amassed in the local market in the first four months of 2017. The amount is also higher than the volume raised by companies in the international market this year through April, at R$36.1 billion. Such transaction volume shows that, in spite of expected volatility due to the electoral year, the decline in inflation and interest rates has encouraged companies to seek funds on the market, and what is more promising: with proceeds meant for investments. Of the stock offerings, 94.6% of the funds were allocated to the acquisition of assets or operating activities. Meanwhile, among debentures, the share meant for infrastructure financing rose to 27.1% from 12.1% between the first four months of 2017 and the same period of 2018.