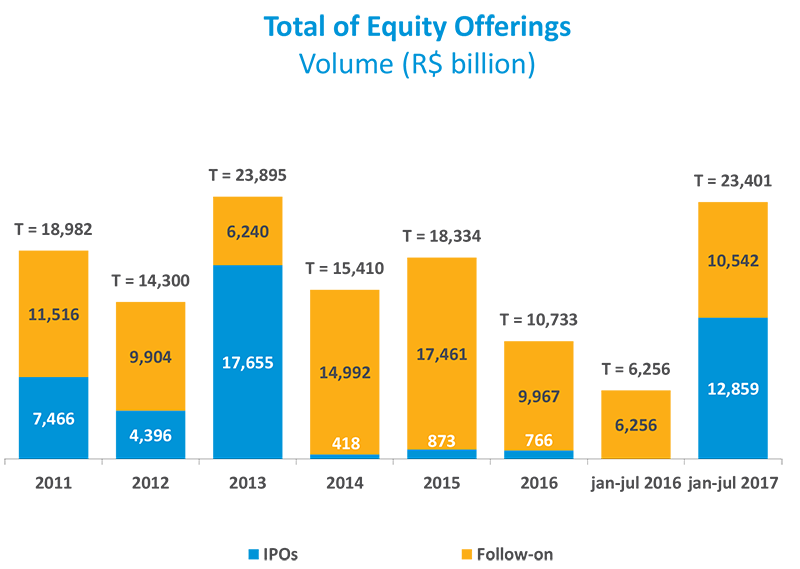

IPOs raise R$9.3 billion in July

Four companies held initial public offerings (IPOs) in July, raising R$9.3 billion. The transactions were led by retailer Carrefour (its cash-and-carry unit Atacadão), with a R$5.1 billion volume; followed by issuances of reinsurer IRB Brasil Resseguros (R$2 billion); pharmaceutical company Biotoscana Investments (R$1.3 billion); and renewable energy firm Omega Geração, which raised R$844 million. The monthly volume is the highest since April 2015, when there was a single follow-on transaction of Telefônica Brasil, of R$16.1 billion. Despite the still unfavorable economic activity indicators, the acceleration of interest-rate cuts and the Ibovespa’s good performance in the month — with a 4.8% gain in July — encouraged companies to carry out their transactions. Two other IPOs are in progress, of food processor Camil Alimentos and IT services provider Tivit. If materialized, these operations will raise the number of initial public offerings to nine in 2017.

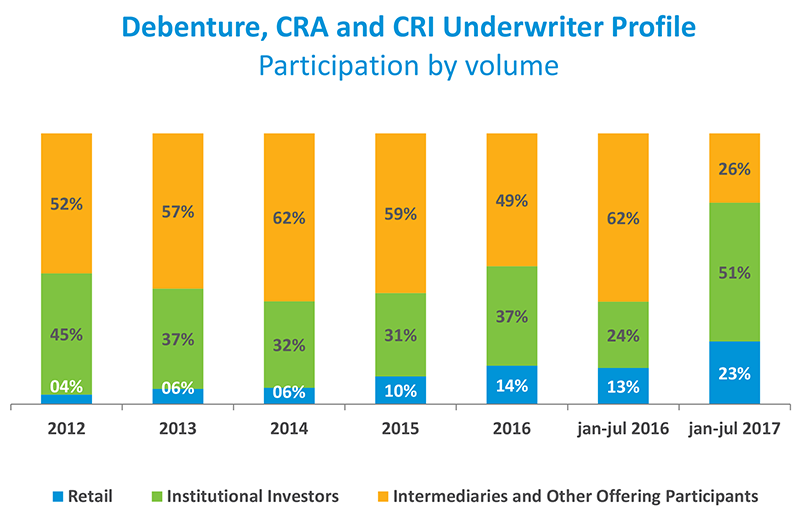

Share offerings boosted domestic funding, which reached R$11.7 billion in July and R$74 billion in the year-to-date. While stock offerings rose nearly fourfold compared to the same period in 2016, issuances in the fixed-income segment and securitization instruments also increased last month, but to a lesser extent (5%). However, investor demand for these assets, including from individuals, has risen in recent months. Of the debentures sold through July, institutional investors and individuals accounted for 63% and 4.8% of purchases, respectively. In the same period of 2016, these shares stood at 13.7% and 1.7%. The same stronger interest from individuals was noted in CRA (Certificate of Agribusiness Receivables) and CRI (Certificate of Real Estate Receivables) transactions, which accounted for 86.3% and 49.3% of the total in 2017, respectively, compared with 78.6% and 9.5% in the January-July period of 2016. This movement is also reflected in the June’s Capital Markets Ranking — Fixed Income, where 74.4% of the structured transactions were distributed to the market in detriment of the portion directed to participants related to the offerings.