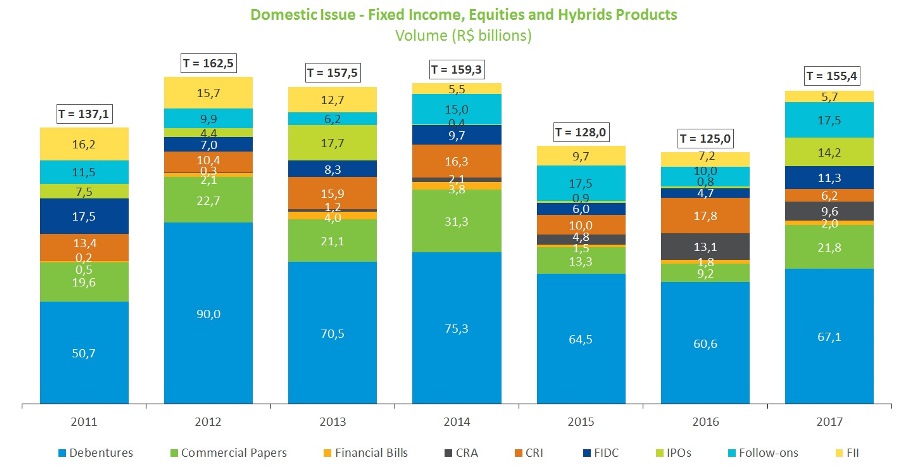

Local funding totals R$155.4bn, surpasses past two years volume

Brazilian companies raised R$155.4 billion in the domestic securities market through November. Volume both in fixed income and equity segments surpassed the total amount raised in 2016 and 2015, signaling that 2017, amid the scenario of falling interest rates and inflation, represented a turning point for local companies.

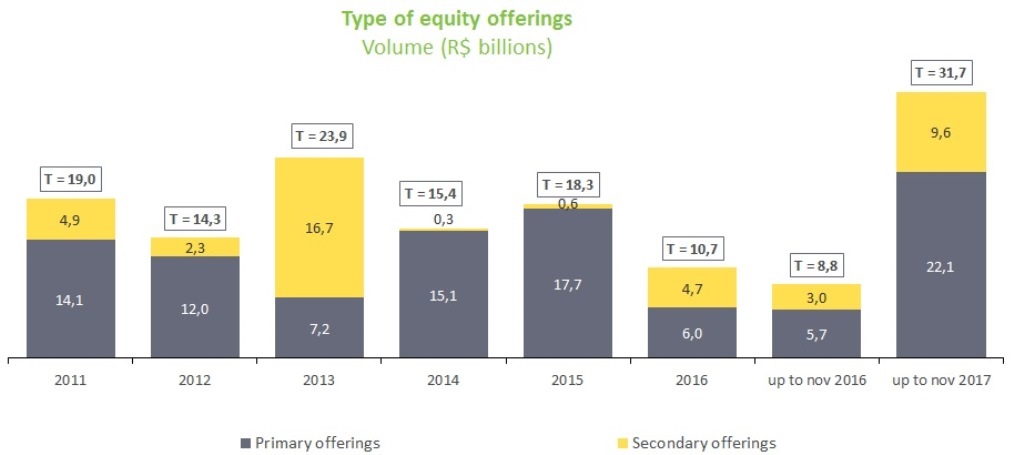

Funding through equities up to November rose 195.2% compared with the same period in 2016, to R$31.7 billion. There was a balance between transactions distributed with ample placement efforts, through ICVM 400 (R$15.9 billion), and those distributed with restricted placement efforts, through ICVM 476 (R$15.8 billion), and a strong focus on primary stock offerings, which totaled R$22.1 billion, indicating new funds flowing into companies’ coffers. Most of the transactions, 45.8%, were related to the acquisition of assets, operations or shareholdings, which also reinforces the increased portion for new investments. In 2016, that share accounted for only 15.5% of the total. At the same time, the amount targeting on reduction of liabilities increased, accounting for 33.5% of the total (compared with 20.3% in 2016), while the volume for working capital fell to 20.7% of the total through November 2017 from 58.5% in 2016.

In the segment of fixed income and hybrid products, the result was also positive. The transactions, which now incorporate public offerings of real estate investment funds and financial bills, amounted to R$123.8 billion through November 2017, up 8.3% compared with the volume for the entire 2016. All the instruments, with the exception of CRIs and real estate investment funds, outperformed transactions in the same period of 2016, with special attention to funding through debentures, commercial papers and FIDCs, which totaled R$67.1 billion, R$21.8 billion and R$11.3 billion through November, respectively. Among debentures, however, the portion of transactions destined for working capital was still bigger, accounting for 42.2% of the total.

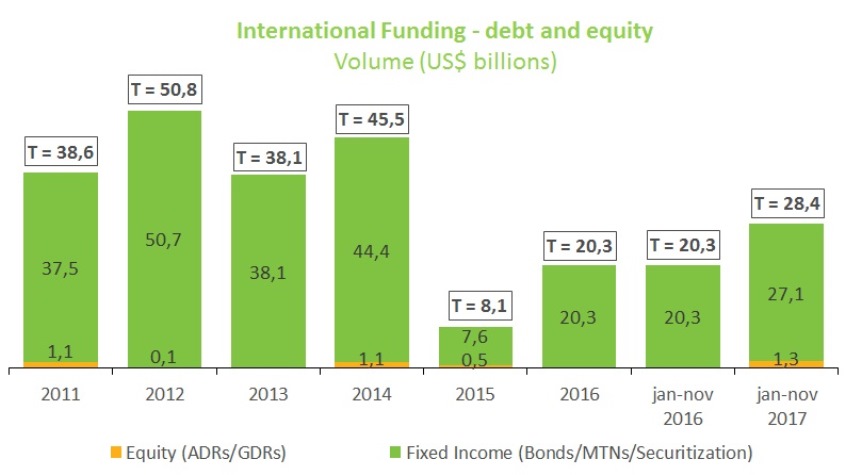

Foreign borrowing by Brazilian companies also benefited from the improved international outlook and positive liquidity conditions. Transactions totaled $28.4 billion, rising 40% compared with 2016. Among the positive indicators, bonds’ higher average maturity stands out, with 81% of them in the 6 to 10-year range, as well as the reduction of average funding rates, to 5.8% in 2017 from 6.7% in 2016.