Fixed income funds raise 106% more in 2021

In December, the fund industry had outflows of R$102 billion led by moves in income funds and FIDCs. Despite this, the industry raised R$369 billion in 2021, 106% more than in the previous year.

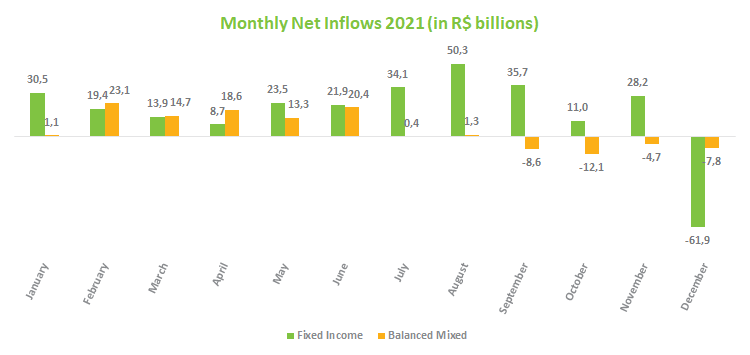

Even with the weak performance in December, fixed-income funds were the positive highlight last year, raising R$215 billion in the period. Alone, the Fixed Income Simple raised R$153 billion, followed by the Short Duration - Investment Grade type, which attracted R$66 billion. The allocation in more conservative portfolios, especially in the second half of 2021, resulted from the combination of investors' higher risk aversion, which was intensified by the tightening monetary cycle started in March, allowing opportunities with lower risk and bigger return. The Long Duration – Investment Grade led gains in 2021 (11.8%), which to some extent confirms the trend while all fixed-income funds delivered gains in 2021.

Balanced-Mixed funds also had losses in December, totaling R$7.8 billion. The Macro type alone had outflows of R$3.6 billion in the period, while the Balanced-Mixed class as whole attracted R$59.6 billion last year, well below the R$104 billion raised in 2020. With lower appetite for risk, investors avoided the segment, with R$31.5 billion in outflows in the second half against net inflows of R$91.1 billion in the first six months of 2021.

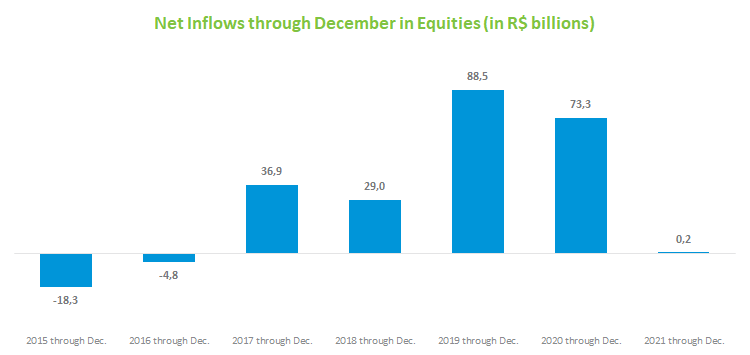

After raising R$57 billion on average between 2017 and 2020, equity funds had inflows of only R$206 million last year. The annual performance was hampered by heavy outflows of R$23 billion in January 2021, just before the start of Brazil’s monetary tightening cycle. The Foreign Equity Funds type went against the grain, with net inflows of R$26 billion.

Credit Receivables Investment Funds (FIDCs) received R$77.1 billion in the period but figures were led by a single fund and did not indicate a general trend.