Fund industry has R$ 20.4bn net outflow in November

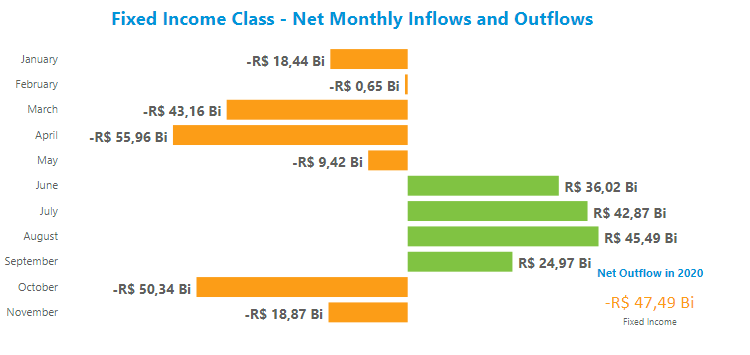

The fund industry saw net outflow of R$ 20.4 billion in November, reducing inflows in the year to R$ 126.8 billion. The result was largely driven by the Fixed Income class, which had net outflow of R$ 18.9 billion, increasing year-to-date withdrawals to R$ 47.5 billion. Among the class types, the Fixed Income – Short Duration Investment Grade underperformed, showing outflows of R$ 8.3 billion and R$ 178.4 billion in November and in the year, respectively. In this respect, the more conservative portfolios’ performance reflected the uncertainty still weighing on the bond market. Despite the moderate recovery, market prices of LTFs, which have a large weight in these funds’ portfolios and are reflected in the IMA-S trajectory, delivered returns below the Selic rate in the period (0.10% against 0.16%).

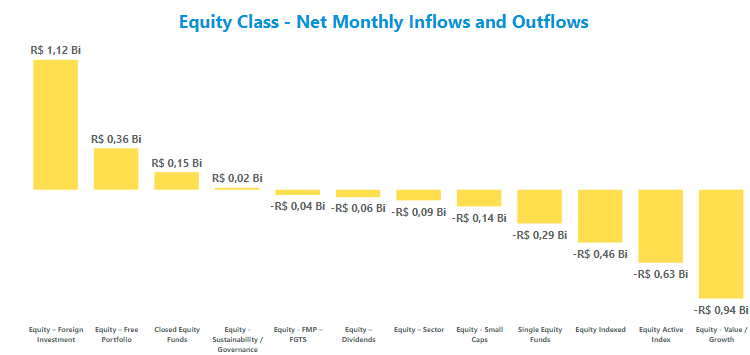

The Equity class also had net outflows in the month (R$ 1 billion), but still shows inflows of R$ 66.9 billion in the year through November. The Equity – Value/Growth type was hardest hit, with net withdrawal of R$ 0.94 billion, but still shows positive balance in the year at R$ 5.8 billion. Its monthly performance to a certain extent is explained by its strategy tied to the economy, which still concerns investors.

The Equity class also had net outflows in the month (R$ 1 billion), but still shows inflows of R$ 66.9 billion in the year through November. The Equity – Value/Growth type was hardest hit, with net withdrawal of R$ 0.94 billion, but still shows positive balance in the year at R$ 5.8 billion. Its monthly performance to a certain extent is explained by its strategy tied to the economy, which still concerns investors.

As for the Balanced-Mixed class, it had net inflows of R$ 1.5 billion and R$ 93.9 billion in November and in the year, respectively. The Balanced-Mixed - Free type had the best performance, attracting R$4.5 billion in November, raising year-to-date inflows to R$ 67.6 billion.

On the yield side, in the Fixed Income portfolio the Short Duration Investment Grade returned 0.17% in November and gained 2.02% in the year. The Foreign Debt type, funds that invest in Brazilian foreign debt, had the worst performance with losses of 5.60% in the month. In the Balanced-Mixed class, the Long and Short types delivered the best returns in November at 3.06%. In the Equity class the highlight was the Equity - FMP-FGTS type, gaining 30.48% in November.