Fund industry has R$63 bn outflow in October

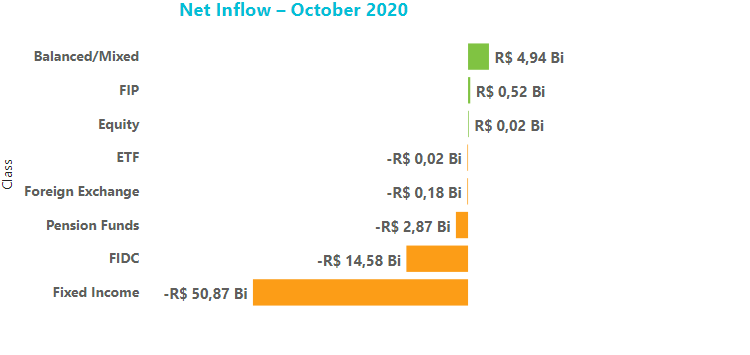

The fund industry had net outflow of R$63.05 billion in October, second only to April, when investors withdrew R$80.5 billion due to the initial impact of the pandemic. Inflows fell to R$134.84 billion year to date, below from the R$250.4 billion raised in the same period a year ago. The trend may be related to uncertainties in the short term, such as the fiscal outlook and stock market volatility, in addition to higher inflation in October, which affected the performance of fixed-rate government bonds. The most conservative portfolios in the segment suffered the biggest impact.

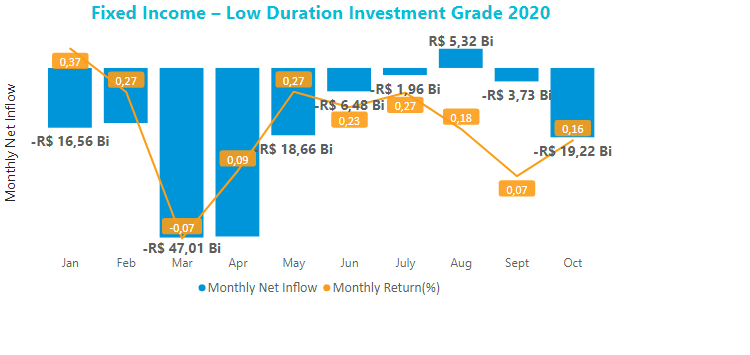

The Fixed Income class led net outflows, totaling R$50.87 billion in October, shrinking the year-to-date amount to R$30.46 billion. Among its types, the Fixed Income – Low Duration Investment Grade, with the largest net assets (R$514.75 billion), was among the worst performers, with outflows of R$19.22 billion in October and R$170.27 billion in the year.

The Balanced/Mixed class had monthly net inflow of R$4.94 billion, ensuring the year’s best performance among classes, with inflows of R$89.41 billion in the year through October. The Balanced/Mixed – Foreign Investment type, with the largest assets at R$532.51 billion, had the highest net inflow in October and remained as the second-best performer in the year, raising R$2.99 billion and R$40.37 billion, respectively.

The Equity class had net inflow of R$0.02 billion last month and R$65.96 billion through October. The Equity – Free Portfolio type, which includes funds without a specific strategy, showed the best result in October and year to date, with net inflows of R$0.63 billion and R$43.43 billion, respectively.

In terms of returns, the Fixed Income portfolio’s Foreign Debt type yielded 2.6% in October, consolidating the year-to-date highest return (47.7%). In turn, the Low Duration - Investment Grade type, which showed strong outflows in the Fixed Income class, returned 0.16% last month and 1.8% in the year. On top of that, the Fixed Income - Indexed saw the lowest monthly return among types (0.05%). Meanwhile, in the Balanced/Mixed class, the highlight was the Balanced type, with return of 0.54% in the month. In the Equity class all types had losses, except for the Closed Equity Funds.