Investment fund industry has R$42 billion inflow in May

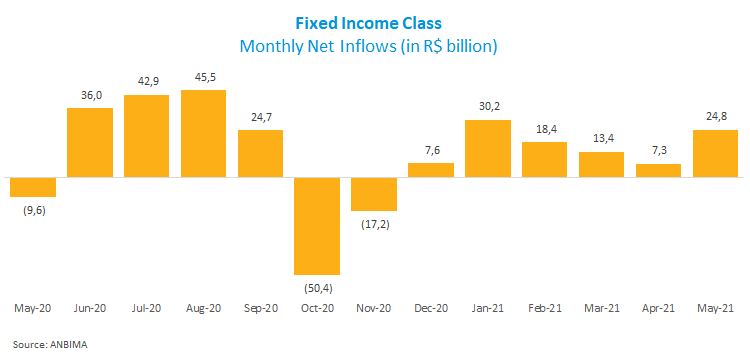

The mutual fund industry had net inflows of R$ 42.2 billion in May, bringing the year-to-date total to R$ 186.2 billion, which compares with outflows of R$ 52 billion in the same period in 2020. Among ANBIMA classes, Fixed Income had the lion’s share with net inflows of R$ 24.8 billion while two short duration, sovereign funds led the moves. This class shows a R$ 94.2 billion inflow in the year through May, the most among ANBIMA types, confirming the monetary tightening’s positive impact on the segment.

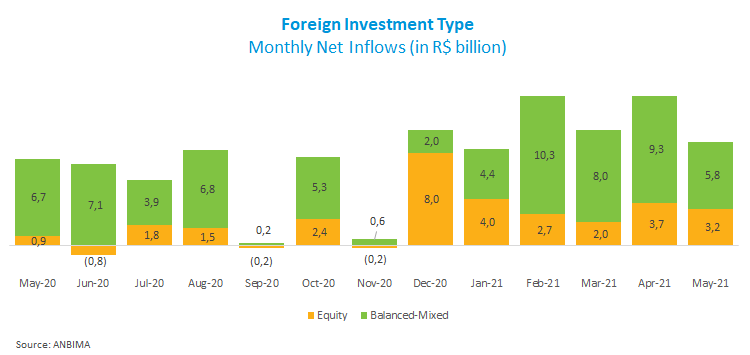

The Balanced-Mixed class comes next, totaling net inflows of R$ 7.1 billion in May and R$65 billion in the year. The highlight was the Balanced-Mixed – Foreign Investment type, which alone raised R$ 5.8 billion.

The Equity Class raised R$ 6 billion in May, with the biggest chunk (R$ 3.2 billion) coming from equity funds with more than 40% of their net assets invested abroad, represented by the Foreign Equity Fund type. In all, equity funds show inflows of R$ 3.7 billion in the year through May.

As for the largest returns in May, in the Fixed Income class, the Long Duration - Investment Grade type gained 1.65%, followed by the Long Duration - Sovereign, which rose 1.12%. These two funds bet in long-duration government bonds and had returns close to the longer-duration sub-indices of the ANBIMA Market Index (IMA). In the Balanced-Mixed class, the Long and Short – Directional gained 2%. In the Equity class, the Single Equity type, which invests in shares of a single company, returned 9.61%.