Balanced/Mixed funds and Equities lead fundraising in Q1

Investment funds raised R$18.9 billion in March, a figure more than four times higher than the R$4.1 billion amassed in February. In the first quarter of 2018, the volume raised reached R$49.9 billion compared with the R$109.9 billion from the same period last year. Among fund classes, the Balanced/Mixed type showed the best performance for the second month in a row, raising R$10.1 billion, followed by Equity funds, which drew R$4.5 billion. The same performance is seen in the quarter, with Balanced/Mixed funds raising R$33.8 billion while Equity funds attracted R$8.8 billion. Fixed-income funds showed outflow for the second consecutive month -- of R$2 billion --, shrinking the year-to-date volume to R$5.8 billion.

As for the amounts raised according to fund types, the highlights among Balanced/Mixed funds were the Macro and Free types, with R$5.5 billion and R$3.2 billion, respectively. Among Equity funds, the highest amount was raised by the Equity Active Index type, totaling R$3.8 billion, and among Fixed-Income funds, the Medium Duration - Investment Grade raised the largest volume, of R$2.3 billion.

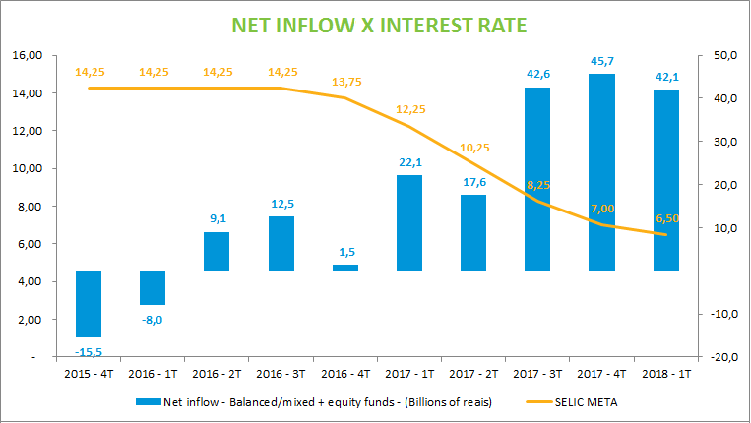

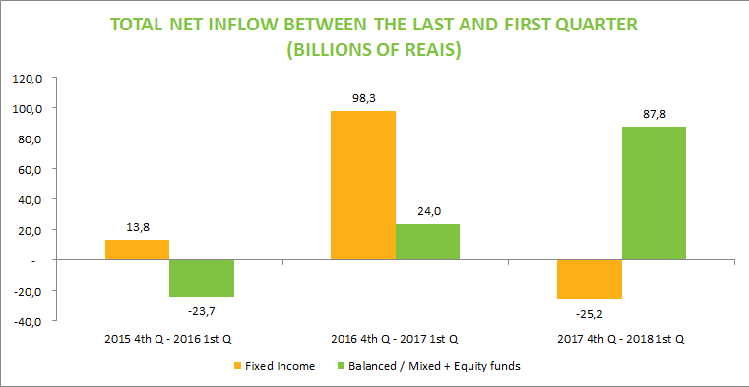

In March, the Central Bank’s statement signaled an additional cut in the Selic rate target at its May meeting, which is likely to speed up the search for higher returns and increase diversification of investments toward assets with greater exposure to risk and longer maturities. In the last six months, resources migrated from fixed income to Balanced/Mixed and Equity funds, driven mainly by retail investors. Since last October, Balanced/Mixed and Equity funds raised together R$88 billion compared with a R$25.1 billion outflow from Fixed-Income funds.

The highest returns in March were seen in the Balanced/Mixed Long and Short - Neutral and Directional types, with returns of 1.53% and 1.40%, respectively. The Free and Macro types, with more representative assets, yielded respectively 0.82% and 0.28%. Following the same trend, the Equity- Free type showed a 0.78% return in the month.