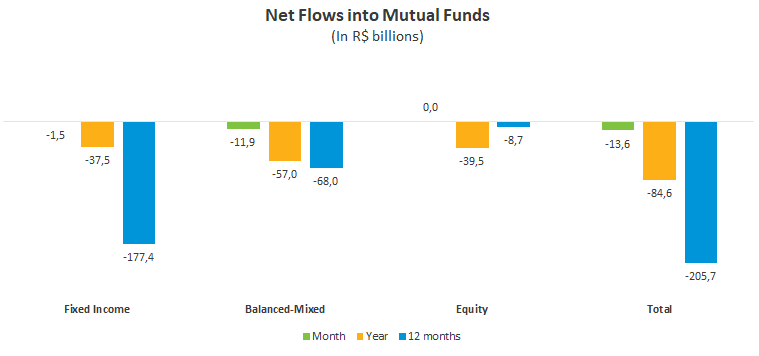

Brazil mutual funds lose R$13.6bn in September

Brazilian mutual funds saw net outflows of R$13.6 billion, a halt to the industry's two-months of net buying. In the year to September, investors have already pulled out R$84.6 billion from Brazil’s mutual funds.

The Balanced-Mixed class led losses, with net outflows of nearly R$11.9 billion. The Balanced-Mixed/Macro, focused on medium and long-term macroeconomic trends, faced the largest withdrawals in the period at R$4.6 billion. The Balanced-Mixed/Free saw net selling of R$2.3 billion, while the Interest and Currency type recorded outflows of R$1.7 billion. The Balanced-Mixed class shows outflows of R$57 billion in the year and R$68 billion in 12 months.

Fixed-income funds saw a reversal of the recent positive trend with net selling of R$1.5 billion in September. This result was driven by conservative portfolios: Fixed Income/Simple, with net selling of R$5.5 billion, followed by Fixed Income-Short Duration/Investment Grade – which holds the largest assets – and the Free Duration/Sovereign, with R$3.3 billion each in outflows. Fixed-income funds lost R$37.5 billion in the year and R$177.4 billion in 12 months.

The Equity class, which already faces net losses of R$39.5 billion in 2023, saw outflows of only R$49 million. The Equity - Free Portfolio, with the largest assets, led the net selling at R$1.7 billion in the month.

Among structured funds, the year-to-date figures are still in positive territory, despite the FIDCs’ outflows of R$3.3 billion in September as a result of a single redemption. The FIDCs have received R$1.6 billion in the year and R$19.4 billion in 12 months. The FIPs, in turn, saw net purchases of R$804.8 million, with R$40.4 billion in inflows in the year to September.

Among fixed-income funds, the Short Duration/Investment Grade type, with the largest net assets in the class, gained 1.02% in September and has already returned 9.59% in 2023. The Equity - Free Portfolio lost 0.47% but is still up 10.42% for the year. In the Balanced-Mixed class, the Free type returned 0.24%, the Macro closed down 0.12% while the Long and Short Neutral fund outperformed with a 1.37% gain in September.