New interest rate level: What to expect from the investment funds industry

By Robert J. van Dijk – vice president of ANBIMA

May/2013

The reduction of the basic interest rate was undoubtedly the most remarkable and influential aspect in the investment funds industry over the past year. The rate was first cut in August 2011 and continued falling throughout almost all of 2012, resulting in a total decline by 525 basis points over this time span and reaching an all-time low of 7.25% p.a., last November. The upshot of this trend was that the investment funds that had bet on falling interest rates were precisely the ones that had the highest returns. The interest rate course also influenced the industry's net inflow, leading investors, although gradually, to seek higher yields, diverting their assets to funds with greater exposure to risk. This response was not more intense due to uncertainties related to the international scenario and the risk adversion of Brazilian investors, historically accustomed to obtaining high real interest rates, even in conservative investment.

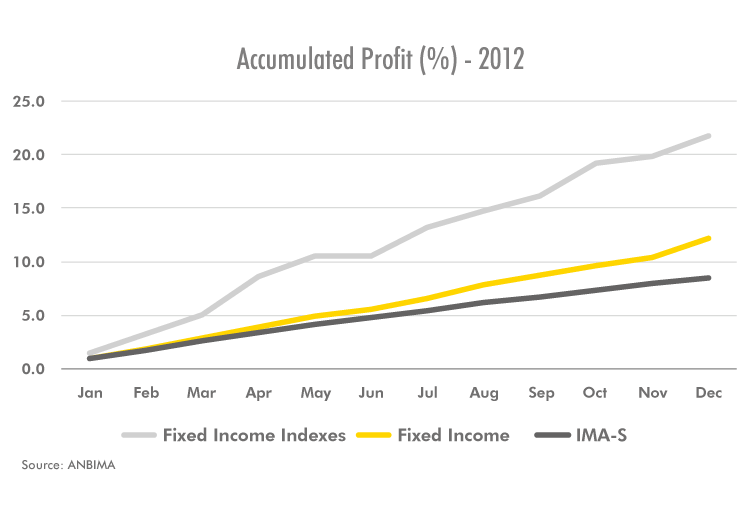

Returns

In this scenario, the funds that profited most from the fall in interest rates were the Fixed Income Indexes. With much of the portfolio comprised of NTN-B (National Treasury Notes - B Series), whose appreciation, measured by the IMA-B (ANBIMA Market Index – composed by NTN-B) was 26.68% for the year, and these funds were the industry's most profitable in 2012, with a 21.71% increase. This result was much higher than the one registered by the traditional Fixed Income funds, of 12.16%, and easily exceeded the appreciation of the IMA-S (ANBIMA Market Index – composed by LFT), which appreciated by 8.50% during the period. It is worth noting that the strategy adopted for the Fixed Income Index funds has been successful since 2011, when the interest rates began to decrease, making these funds the industry's most profitable in a 24-month period.

Some Hedge Funds in the Balanced/Mixed category, which trade in several asset classes, as fixed income, variable income, and foreign exchange, also performed well. In addition to the appreciation of inflation linked securities, the managers profited from the dollar hike of 8.94% and the favorable performance of shares linked to domestic consumption as evidenced by the 40.44% increase of the Consumer Index - ICON, calculated by the BM&FBovespa (São Paulo Stock Exchange). This is the case of the Balanced / Mixed Macro Funds, which trade in multiple markets, based on medium and long-term macroeconomic scenarios. With an 18.14% increase, these funds showed the category's highest returns of the year, outperforming the appreciation of the main indicators of fixed income and variable income during the period.

Despite the appreciation of shares linked to domestic consumption, the variable income market experienced a new period of instability in 2012, especially during the first semester, influenced by uncertainties related to the international crisis. However, despite an adverse scenario, some distinctive strategies yielded significant gains, even close to those seen by the Fixed Income Index funds. Notable among these are the Small Cap Equity funds, with an increase of 20.56%, and whose portfolio must invest predominantely in stocks of low or medium market capitalization, generally focused in the domestic market. The Free Portfolio Equity funds, which concentrate the category's AuM and whose investment policy gives greater freedom for portfolio management, also performed favorably, increasing by 19.29% for the year. Many of these funds adopted alternative strategies, excluding Ibovespa's most liquid stocks from their portfolios.

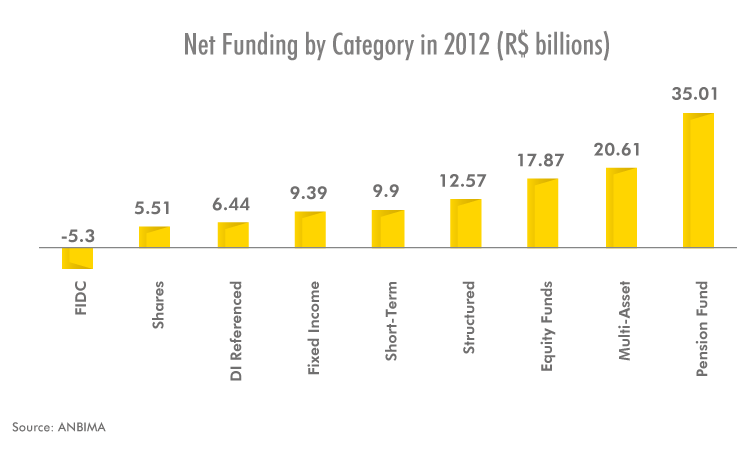

Net Sales

The reduction of interest rates also affected the industry's net sales, which reached BRL$ 97.6 billion in 2012, the third best result of the series, although it has affected, in different ways, some fund categories. The decreased yields substantially reduced the net amounts invested in the Fixed Income funds' category. However, the net sales of BRL$ 31.8 billion reported in the Fixed Income Index funds, stimulated by attractive returns, more than compensated for the net redemption of BRL$ 24.8 billion in traditional Fixed Income funds. The DI-Linked category reported net redemptions of BRL$ 21.3 billion in funds targeted at Retail customers, but still showed positive net sales thanks to the net inflow of BRL$ 20 billion in a single fund of the corporate segment in March.

Nevertheless, the reduction of interest rates also seems to have caused a demand for funds with greater exposure to risk. This applied to the category of Balanced / Mixed Funds, which reported net redemptions in 2011 and, in 2012, had the industry's second greatest net sales. First place went to the Pension Fund category, which has shown consistent growth in recent years. In fact, in order to ensure the same level of benefits expected at the former interest rate level, the new level should require an increase in the value and in the length of the investment period in these funds.

However, it is noteworthy that in the last four years, the best yearly results were recorded, featuring the industry's recovery after the international crisis, consolidating it as the 6th largest in the world, with AuM of BRL$ 2.3 trillion (or US$ 1.1 trillion) - a growth of nearly 100% since the end of 2008.

Challenges

At the end of 2012, some may still wonder: is the new interest rate level here to stay or is it only temporary? Can an inflation increase cause the Copom (Monetary Policy Committee) to raise the interest rates again? These questions make sense, especially when taking into account the country's history of monetary policy and the expectation of increased inflation, especially starting from the second semester of 2012. However, ANBIMA's Macroeconomic Monitoring Committee's projections suggest a continued Selic (Special Clearance and Escrow System) Rate (Basic Interest Rate) of 7.25% until the end of 2013, or rather, stable interest rates at a historically low level. Whatever the nominal interest rate to be determined by the Central Bank during the year, there seems to be a consensus that the real interest rate level should not increase significantly.

Thus, everything indicates that the new interest rate level should continue influencing the industry in 2013. In this context, although the maintenance of the Selic rate and possibly the exchange rate may suggest a reduced volatility scenario, it is worth noting that the demand for longer-lasting assets in pursuit of greater yields makes portfolios potentially more volatile. This is because the impact of the price of securities resulting from a change in expectations or economic scenario is greater for long-term assets, depending on the period of exposure to the interest rates.

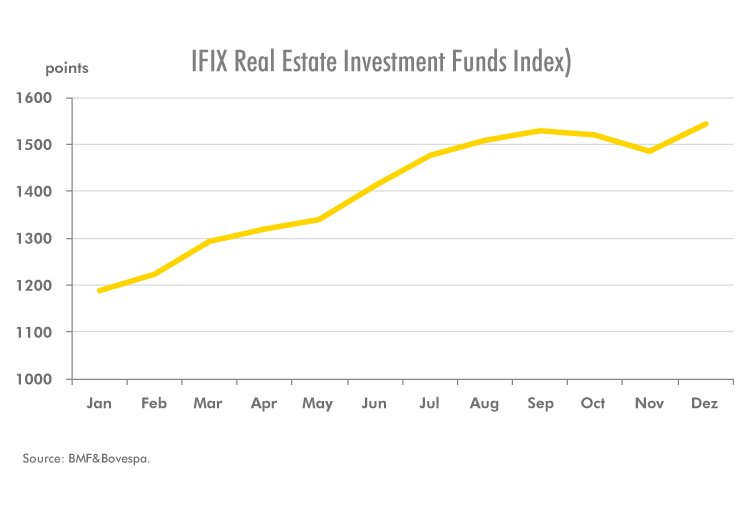

Furthermore, although the margin for gains from the falling interest rates has been reduced, it is reasonable to expect that the demand for greater returns also stimulates portfolio diversification. In addition to private securities, diversification in the investment fund industry must also include the so-called structured funds, such as FIDC (Credit Receivables Investment Funds), Real Estate Investment Funds and Private Equity Funds. With regard to the former, after 2012, marked by the uncertainty generated by problems occurring in specific funds and by the introduction of significant regulatory changes, it is expected that the establishment of the FIDC's regulatory framework, with more clearly defined responsibilities, as well as the inclusion of such funds (by Provisional Measure No. 601/12) among those benefiting from the tax exemption of Law no. 12.431/11, may, to some extent, help to stimulate new issuance of these assets.

In relation to the Real Estate Investment Funds, we expect a favorable performance achieved by these funds in 2012 to continue. This can be measured by the year's appreciation of 35.04% of the IFIX (Real Estate Investment Funds Index), calculated by BM&FBovespa. The high return and the tax exemption levied on income distributed to individuals, plus the Brazilian investor's increased familiarity with the real estate market, have favored the growth of not only the AuM of such funds, but also the number of investors, which are both crucial factors for market liquidity.

Reducing uncertainties related to the international scenario, along with adopting measures to accelerate the growth of the Brazilian economy, should help the Private Equity Funds, usually targeted towards acquiring shares in companies by qualified investors, maintain the momentum.

In short, in view of the new interest rate level, adjustments must be made in the fund industry. In this context, ANBIMA, acting as a self-regulatory entity in the financial and capital markets, has a broad agenda aimed at promoting the best practices and the sustainable growth of the funds industry in the coming years. Among these initiatives, on one hand, are those aimed at promoting better-informed investment choices, focused on improving information for investors by establishing minimum standards on the funds fact sheet in order to ensure the comparability among products, and extend suitability (API) for all retail investment products. On the other hand, are the proposals aimed at improving the products and services offered to investors, with the improvement of liquidity management guidelines, with an emphasis in private credit, the discussion of initiatives for the development of a secondary securities market, in addition to discussing proposals to reduce fund maintenance costs.

Therefore, although it is impossible to determine what the interest rate level will exactly be, it is certain that the changes in the investment funds industry to adapt to the new scenario are already underway.