Prospects for the Brazilian Investment Funds Industry

By William Eid Junior - Full professor at FGV and GV Cef (Finance Research Center Diretor)

Ricardo Ratner Rochman - Coordinator professional master in economics of the São Paulo School of Economics

May/2013

Long-term prospects for the Brazilian investment funds industry are extremely favorable. Over the years, mechanisms have been instituted that today fully justify the claim that Brazil's investment funds are currently among the world's safest, best organized and most transparent. Examples of such mechanisms are daily disclosure of key data like market volume and prices, the fact that asset administration, asset management and custodians are different entities, as well as the industry's traditional self-regulation, which established standards of conduct for all industry participants.

The industry's favorable prospects are fueled by the country's current economic situation. On one hand, our real interest rates are relatively low while on the other hand, Brazilians are becoming increasingly aware that they must save for the future since the state-run retirement system has drastically reduced the value of pensions in recent years.

The low current real rates of interest drive investors to seek more sophisticated investment products than traditional savings accounts and CDs. This creates a strong demand for investment fund products since these are the most affordable vehicles for savers desirous of switching to a more profitable placement of their funds.

The industry has responded to this demand by offering a greater number and variety of products, such as funds that invest in inflation-linked bonds, which protect investors' assets from the effects of currency depreciation. However, there are many more as shown by the recent growth on our market of ETFs (Exchange Traded Funds). In the field of retirement planning, so-called life-cycle funds, which alter their portfolios' composition as the investor ages, thus reducing exposure to risk, also show the industry's dynamic presence.

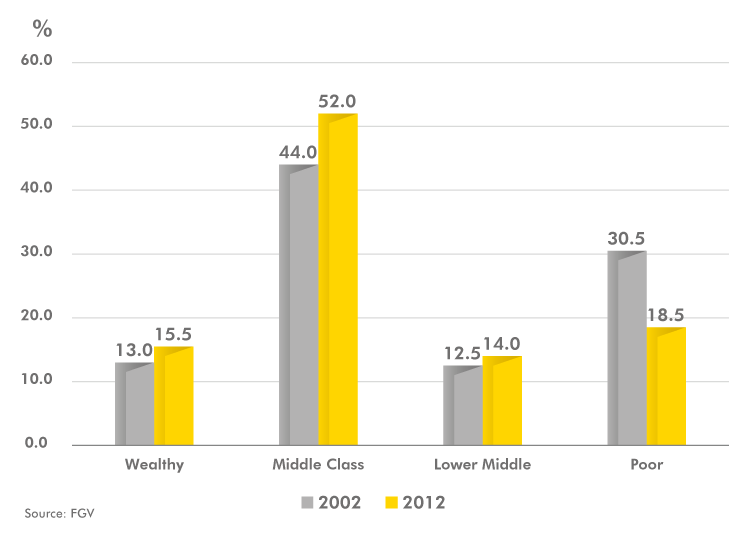

Moreover, most investors' awareness for the need to invest aiming at retirement is an additional powerful lever for the investment funds industry. It is foreseeable that, within a few years, the state retirement system will only cope with the poverty-stricken masses, and not being able to assist the middle class overall. The middle class has grown in recent years as can be seen from the following graph, which compares data for 2002 and 2012. Finance education programs, previously non-existent during the last decade, now lead more and more Brazilians to think about the future and the world of investments.

The Brazilian middle-income and wealthy classes together number more than 130 million people. Every last one of them is a current or potential investor whose financial plans will undoubtedly spur on the investment funds industry's future growth. We also note that, in the last ten years, the poor have diminished as a share of the population from 42.5% to 32.5%. In other words, 20 million people have entered the ranks of the middle class, thereby becoming 20 million budding investors. Currently only some 10 million Brazilians can be considered active investors. This amounts to less than 10% of the potential market.

Turning now to the subject of retirement planning, the new middle class will inexorably invest in these products. The choice of investment options can only grow. Today the Brazilian finance industry still offers the consumer a fairly conventional assortment of investment products, based on various combinations of asset allocation between variable and fixed income. In the near future, this offer will be expanded with more sophisticated products, offering investors a more varied choice.

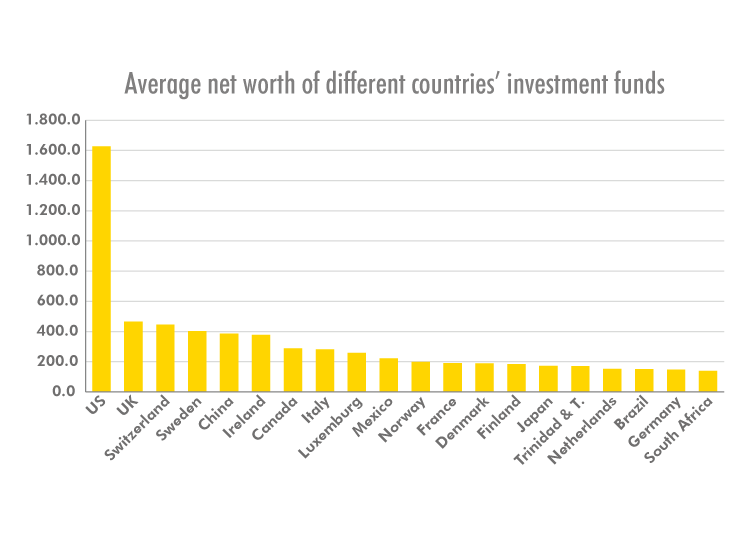

The international market also offers attractive prospects. At present, some 4% of the USD 26 trillion in global mutual fund assets is located in Brazil. The global mutual funds industry is still heavily concentrated in the United States, with 49% of total assets, followed by Europe with 30.3%, and Asia and Oceania, with 12.3%. One of the most remarkable facts about the Republic of Ireland is that, despite a population of only 6 million and its modest size, measuring scarcely 32,595 square miles, the country holds USD 1.2 trillion in mutual fund assets, equal to 4.7% of the industry's total assets worldwide. More than one finance industry professional has wondered how Ireland ever succeeded in expanding its mutual funds industry to attain such impressive size.

The answer to this question is the focus both on the investor and on international financial service providers. The Irish government made substantial investments in infrastructure for the investment funds industry, for example, custody, audit procedures, capital flows and legal arrangements, among others, to satisfy the requirements of fund managers located worldwide. The country also amended its tax laws to attract investors and fund managers, thus easing capital inflows. Ireland signed treaties among their local authorities and with other countries, such as China, the United States, Switzerland, and the European Union, thereby exempting non-resident mutual fund investors from Irish taxes on both capital gains and distributed profits. These are some of the factors that turned Ireland into a center for investment in the international mutual funds industry.

Brazil has great potential for attracting foreign investors because its financial industry has professionals with great expertise and international experience, comprising a wide range of investment funds to cater to customers and broad investment opportunities in both fixed and variable income instruments, which derive from a credit and capital market, that is yet in the early stages of its development, especially if the Brazilian government simplifies and reduces the tax burden on investment funds and on fund managers.

Brazil still offers mutual funds much room for growth. While, in Brazil, the average investment fund's net worth is about USD 151 million, the comparable figure for Ireland is USD 378 million, and that for the U.S. is USD 1.6 billion. That means that there is considerable room for growth within the industry as it stands today, not to speak of the substantial potential for future recovery by increasing efficiency, cutting costs, optimizing government regulation and upgrading the infrastructure on which the industry relies. However, in order to attain these goals, it is crucial to define a global rank for the Brazilian investment funds industry, which must be discussed among its participants and stakeholders. After all, this will determine the amount of the country's future capital inflows, and thus whether the growth potential will become reality in coming years.